Strong wind in its sails

We are experiencing very high demand for logistics properties, but transaction volumes going sky-high has been prevented by supply side restrictions. At the same time, the outlook is good in the rental market and many tenants have emerged strengthened from the pandemic.

Transaction market

We are aware of 34 property transactions so far this year in the warehousing, industrial and logistics segment, with a combined volume of about NOK 10 billion. That is at about the same level as in the corresponding period of last year. A number of attractive properties have changed hands, including the Optimera building and the new DSV headquarters/main warehouse in Vestby. The main Coop warehouse at Gardermoen is in the process of being sold.

*At November 2020Source: UNION

A number of land purchases have also been seen recently, including a site of about 10 hectares in Vestby acquired by NREP from Ferd Eiendom. After the summer, it also became known that Bulk Infrastructure had joined forces with Mr Pukk AS to acquire two development sites totalling 40 hectares in Enebakk.

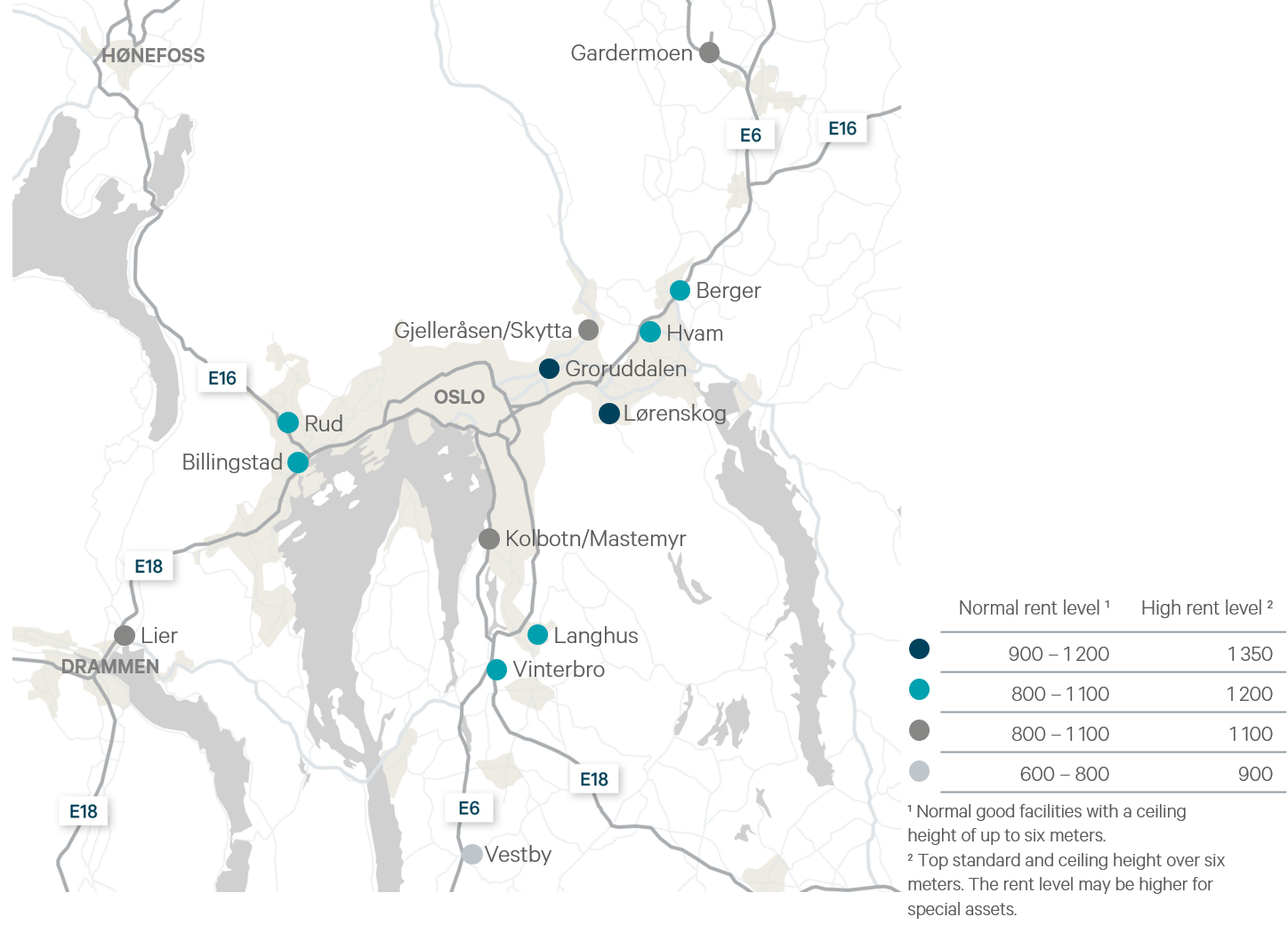

Despite a relatively low number of transactions compared with earlier years, we see good liquidity in this market. Demand is particularly high for new properties close to a main road into Oslo, with solid tenants and leases which have many years left to run. Record-low interest rates and greater uncertainty in several other segments have increased investor appetite for long and secure cash flows.

We have downgraded our estimate of prime yield for logistics properties by 35 basis points since February, and believe that the best assets are now achieving a yield of 4.40 per cent. That assumes a modern logistics building strategically located on a main road into Oslo and a lease of about 10 years with a financially sound lessee. Properties with extraordinarily long leases will normally achieve an even lower yield.

Source: UNION og DNB MarketsRental market

Prospects for the rental market for logistics property have moved in a positive direction in recent years. The substantial expansion in online shopping has favoured increased demand for warehousing and logistics space. On average, an online player uses about three times as much logistics space as a traditional physical retailer.1 At the same time, end users are making ever more stringent demands for precision, efficiency and accessibility. That in turn affects investment in terms of location and technology.

This trend has now been reinforced by the pandemic. Remote working, infection control considerations and travel bans have led to a shift in demand, and the Norwegian consumer is again spending more on goods than services. In addition, the government’s calls to avoid gatherings have made online shopping a safer channel for many consumers.

The postal service has reported growth of about 60 per cent in online shopping on a national basis during the second quarter, compared with the same period of 2019. In Oslo, this increase was no less than 86 per cent.² In addition, a survey by Bring shows that a growing number of Norwegians want parcels delivered all the way to their front door.³

One player who has experienced a big increase in demand as a result of Covid-19 is Kolonial.no. The company has therefore chosen to bring forward construction of a new main warehouse by nine months. This facility will be located at Liertoppen, on the E18 highway between Oslo and Drammen. Due to exceed 18 000 m², the building will be environmentally certified to Breeam In-Use. Semi-automated production lines and other innovative logistical solutions will more than double the company’s capacity and ensure optimised operation as well as opportunities to reach new customers. Kolonial is unlikely to be alone in growing out of its present facilities.

¹ Source: Prologis

² Source: Posten Norge

³ Source: Bring