Newbuild forecasts scaled back further

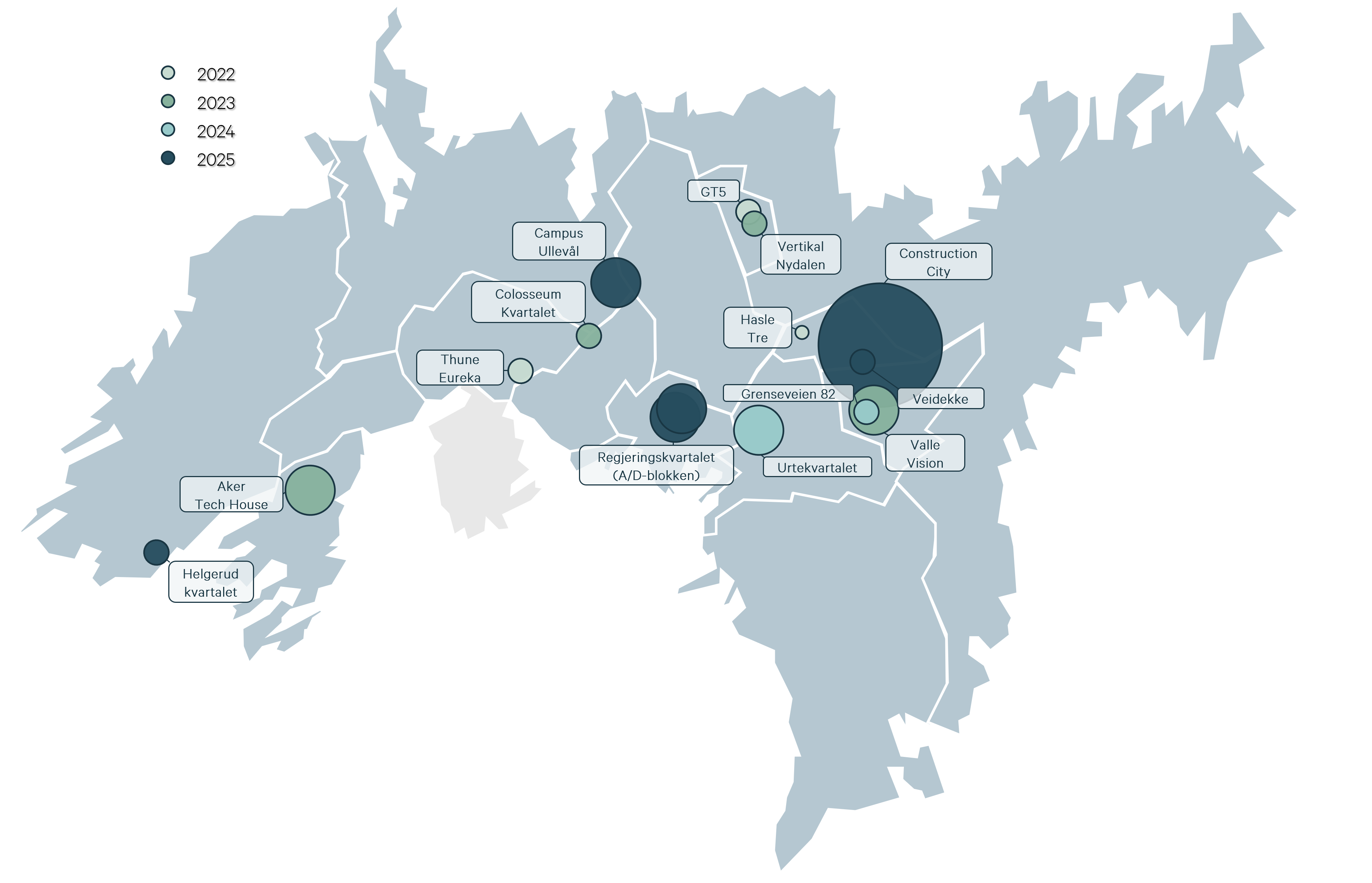

New office construction remains extremely low. We expect a total of about 160 000 m² to be completed in 2022-24 – in other words, an annual average of just over 50 000 m². By comparison, the newbuild volume has averaged 120 000 m² since 2000.

After two years of high newbuilding activity, less than 30 000 m² of new office space is due to be completed in 2022. This low volume primarily reflects the limited number of construction starts at the beginning of the pandemic because of both great uncertainty and increased raw material prices.

Completions in 2023 are set to total 70 000 m², with Aker House at Fornebu and Valle Vision at Helsfyr accounting for the bulk of the space. We expect the newbuild volume in 2025 to be lower than previously assumed, and our estimate has been revised down from 100 000 m² to 60 000 m². Veksthuset in Urtekvartalet and Helsfyret at Grenseveien 82, with a combined volume of 35 000 m², are the only newbuildings confirmed for 2024 so far, but more may come. The 2024 estimate has been reduced because several projects have been pushed into 2025.

In the latter year, the newbuild volume is set to rise sharply – probably to around 185 000 m². Two projects in particular add to this volume.

-

Construction City, where 80 000 m² in new office space will be completed in 2025. Veidekke is also moving its head office from Skøyen to a new 11 300 m² building on the neighbouring site at the beginning of 2025.

-

Government quarter: Plans call for blocks A and D (totalling 47 000 m²) to be completed in 2025. However, a number of delays have occurred already, and we would not be surprised if completion were postponed even further.

In other words, newbuilding activity in the city centre is very low. Veksthuset at Urtegata 9 and the first construction phase for the government quarter will probably be the only completions in the forecast period. On the other hand, a number of large refurbishment projects are under way in the city centre, including Storebrand’s total renovation of Filipstad Brygge and Norsk Hydros Pensjonskasse’s project at Bygdøy Allé 2.

Construction activity on the eastern outskirts has been very high for a number years, with rents down towards NOK 2 000/m² in a number of cases. The big supply of new projects has put a ceiling on rent developments. Thanks to a sharp fall in yields and moderate construction costs, it has been possible to lease these buildings at low rents. However, we believe tenants must expect to pay more in coming years.

The low level of building activity and a strong macro economy have contributed to a tight letting market. Office vacancy in Oslo has now declined to 5.7 per cent, down by 0.7 percentage points during the past half-year alone. Demand for office premises has so far been very high, and vacancy has fallen in virtually all office areas.

Vacancy in the city centre is only five per cent, down 1.3 percentage points from six months ago.1 It is now 6.6 per cent on the eastern outskirts, the lowest level we have ever measured, and has fallen 0.8 percentage points over the past half-year. The main explanation is that vacancy at Økern declined sharply after vacant premises in both Parallell and Økern Portal were leased in recent months. Vacancy at Lysaker appears to have flattened out at a record-low 3.3 per cent. It is also stable in the rest of the western outskirts at just under six per cent. One exception is Fornebu, where vacancy has risen from 6.4 to 12.6 per cent over the past year.

We believe that vacancy has bottomed out this time round. Our expectation is that it will rise slowly but surely as the Norwegian economy weakens. Much of the new space appearing over the next few years is already let, but tenants moving in will leave office premises behind which will become vacant. In the city centre, for example, vacancy will rise as the ministries move back into the government quarter. This will admittedly take place over several years, so we don’t believe it will have too much effect on the rental market. Construction City is being filled with tenants moving primarily from the city centre, Helsfyr and Kværnerbyen. Veidekke and Sweco will be leaving 25 000 m² when they move from Skøyen and Lysaker respectively.

1 CBD, Bjørvika and the inner centre