Increased uncertainty affects the supply side

We are heading into a period with relatively few new office completions in Oslo. A slowdown in newbuild activity was expected, but is being reinforced by more uncertainty on several fronts.

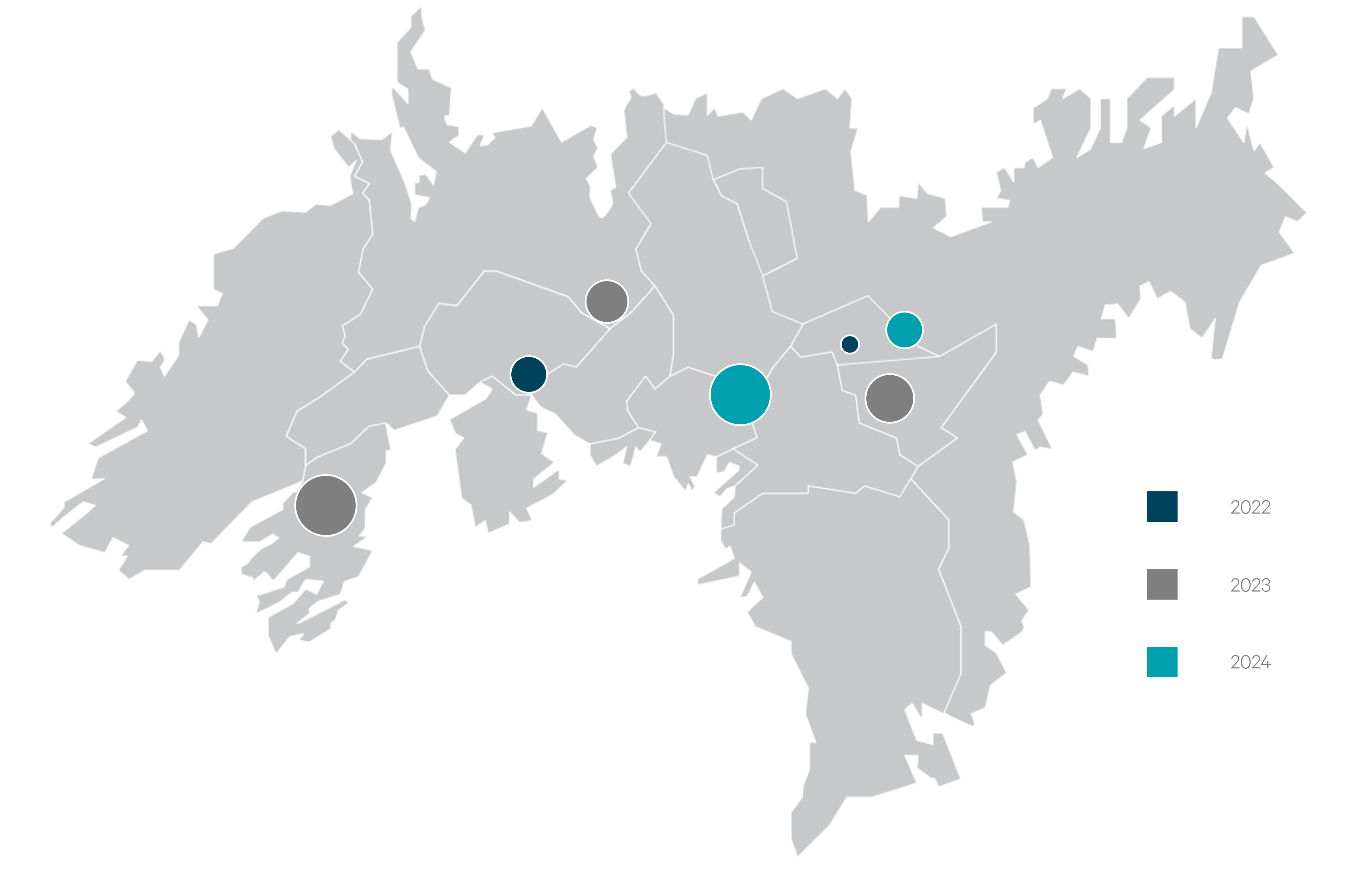

After two years of solid supply-side growth, new office building has declined sharply. Only 30 000 m² of additional space is due for completion this year. Four office buildings totalling 70 000 m² have so far been confirmed for 2023. This figure is a little uncertain, and we assume it could rise to 90 000 m². While only two further office buildings totalling just over 40 000 m² have been confirmed for 2024 at the moment, we expect the final volume to be about 100 000 m². This means we are probably now on the way into a three-year period with the lowest newbuild activity in the capital since 2008.

Several factors explain the low construction activity in the office market, including the uncertainty introduced by the pandemic.

Building costs are now also rising at full speed and putting a further damper on activity – not only because it is more expensive to build, but also because uncertainty about cost trends during the construction period has been very considerable.Builders naturally do not want to bear this risk, at least unless covered by sky-high premiums. It has thereby become difficult to secure fixed-price contracts which lock in the costs.

In addition, we now see that interest rate developments are helping to increase uncertainty over future yields. The profitability of a development project is obviously sensitive to the assumed sales value when the building is completed.

In other words, several factors are pulling in the direction of higher rent levels in newbuilds and will also probably lead to a number of projects being put on hold.

Office vacancy in Oslo is 6.4 per cent. Largely stable over the past four quarters, this has probably peaked for now thanks in part to the moderate supply-side growth expected. We expect that future demand will be strong enough to pull office vacancy down towards 5.5 per cent over the year and become established in that range for the time to come.

However, some office areas are still characterised by surplus space after a number of completions in 2020-21. That includes 12 000 m² in Økern Portal, while Parallel – a couple of hundred metres further south – still has more than 13 000 m² to fill. Nevertheless, vacancy at Økern has declined by 4.5 percentage points over the past year and is now 13.3 per cent.

Office vacancy in the central business district (CBD) is now around six per cent – lower than a year ago, but still higher than the 4.6 per cent reached when it last bottomed out in the spring of 2020. Much of the increase can be attributed to the completion of VIA. Most of the tenants in this building moved within the district, and a number of vacated spaces are awaiting new occupants. Vacancy is expected to increase further as a result of major refurbishment projects. The Storebrand building at Filipstad Brygge is almost empty, for example, with an extensive refurbishment planned for completion in 2024.