Favourable supply side ahead

A high level of supply growth over the past two years has contributed to increased vacancy in several parts of Oslo. Looking ahead to 2022, we are moving into a period with reduced newbuilding and with vacancy likely to peak during 2021.

Since bottoming out at 5.3 per cent in the third quarter of 2019, office vacancy in Oslo has seen a slow but sure upward trend and is now at 6.6 per cent. Big differences exist between the various city districts, and vacancy has been lifted sharply by developments in the central areas. From 31 December 2018 to mid-2020, it was at a historical low of 3.5 per cent. That has now risen to 6.2 per cent, the highest level we have seen in almost four years.

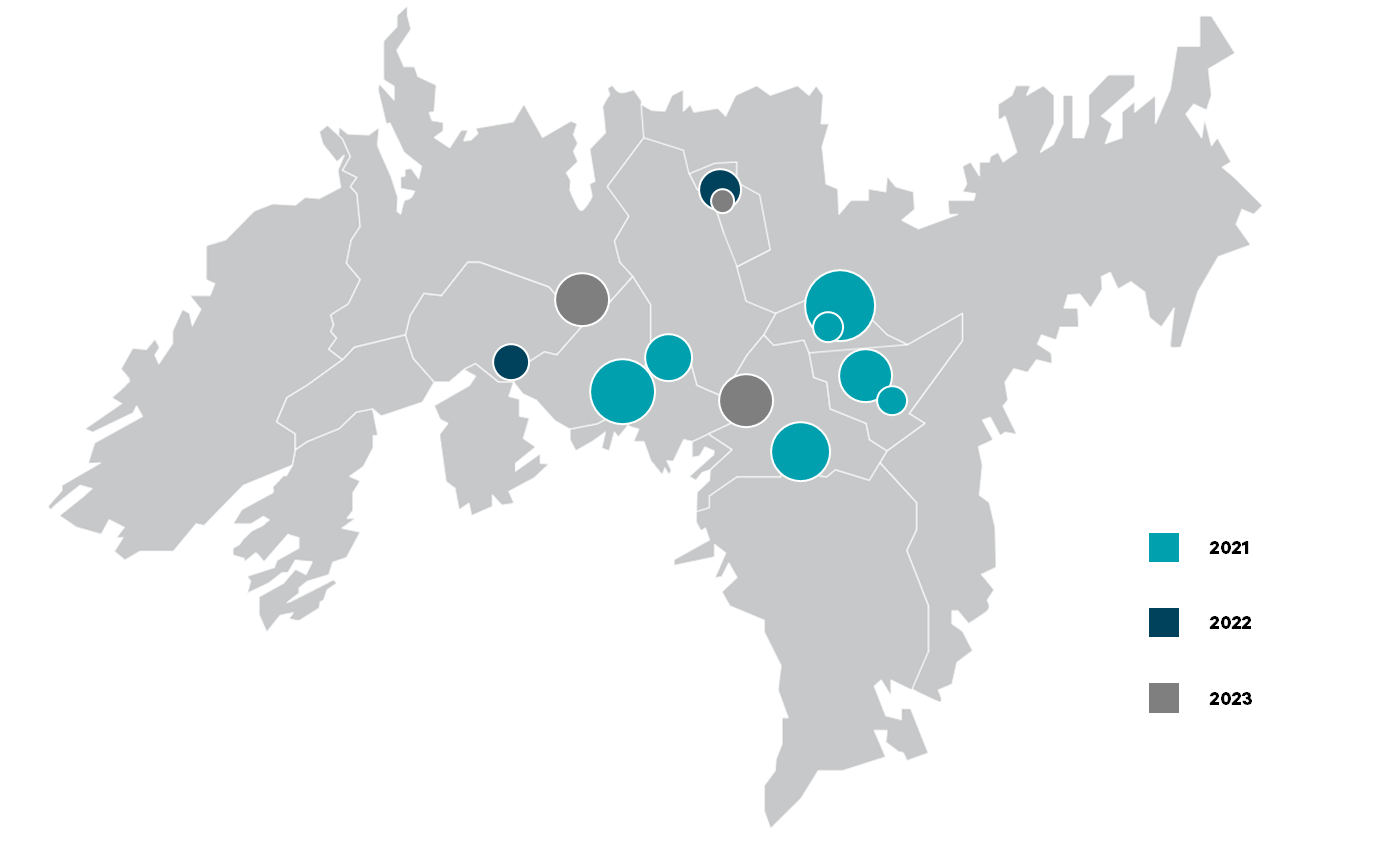

However, increased office vacancy in the capital comes as no surprise. This development is largely a consequence of additional space becoming available in a number of newbuilds completed in 2020 and due for completion this year. A total of 150 000 m² in new office space arrived in 2020, and 17 per cent is still without a tenant. Another 170 000 m² is due for completion this year, 30 per cent of it tenantless.

Newbuilding activity in recent years has indisputably been at its highest in the areas east of the city centre. Little new construction in the city centre over the past few years, combined with strong rent rises, have “forced” a number of large tenants out to the fringes. That applies particularly to public-sector players, such as the Norwegian Directorate of Immigration (UDI). The latter recently moved from Hausmannsgate 21-23 to Valle View at Helsfyr. In other words, newbuilding in the fringe areas has also affected the market balance in the city centre.

Tenants moving to the newbuilds leave vacant space in existing premises. In some cases, whole office buildings have been left empty. A proportion of this space has already been advertised in the market and is thereby included in the calculation base for vacancy. Other properties, such as Ruseløkkveien 14 and Bygdøy Allé 2, are still not available in the market.

A number of large tenants are also choosing to move internally in the office areas. Storebrand and Aspelin Ramm, for example, have filled up almost the whole VIA newbuild with tenants currently based elsewhere in the CBD. At the same time, several buildings in the city centre will be empty.

Newbuilding activity west of Skøyen has been at a standstill ever since Philip Pedersens vei 11 at Lysaker and Hagaløkkveien 26 in Asker were completed in 2018. That has contributed to keeping vacancy down in recent years. In addition, the rental market has become far less petroleum-driven since the previous oil crisis. The Storting (parliament) moreover approved temporary changes to the Petroleum Tax Act in June 2020 with the aim of allowing planned investment to be implemented and thereby “shielding” jobs. This area has also attracted a number of large companies in the IT sector, which have increased their staffing substantially over the past year. At the same time, the heavy commitment of the energy companies to renewables has created fertile soil for increased employment in the area.

After two years with a high level of construction activity, we appear to be entering a period with little newbuilding. Few starts in 2020 have led to a low newbuild volume for 2022. Only 25 000 m² in new office space will be completed for that year. Where 2023 is concerned, confirmation has so far been received that 81 000 m² of office space will be completed. We expect this to contribute to declining office vacancy from 2022.