Real Assets in a New World

The low-interest regime following the financial crisis, especially from 2015 to 2022 for Norway, led to an intense pursuit of returns. Money flowed into real estate and other unlisted investments. However, generating returns is now easy.

The hunt for yield is thus over, and "everyone" wants to invest in debt, with or without credit risk. Why buy property at a yield of five or six percent when you can get seven or eight percent by taking moderate risk in the bond market?

The same argument can also be made for the stock market. The risk premium on the S&P 500 is at its lowest in over 20 years. We have to go back to the period before the dot-com bubble burst to find a lower level.

One possible interpretation is that investors believe that interest rates will remain high for a long time, and simultaneously believe that the economy is strong enough for future income growth to justify today's prices. Another interpretation is that the stock market believes the bond market is wrong about interest rates, at least in the sense that interest rates will be at a completely different level if income growth falters. In that case, macroeconomists who believe that we are now facing a longer period of both weak growth and high interest rates could be wrong.

Regardless, it's a reminder that the risk premium observed in various valuation multiples varies over time, and it's prudent to exercise a certain degree of humility when navigating the market. Today's multiples are also not the same as future returns, either for stocks or real estate.

Still Strong Arguments for Real Assets

Many believe we are entering a new era of sustained high inflation. You are familiar with the arguments—the green shift, globalization in reverse, and the reconstruction of Ukraine, among others. There is, of course, a fair chance that this is correct. Let's assume that we have seen a shift in the inflationary trend, even though the collective narrative can change faster than you think, as it has done so many times before.

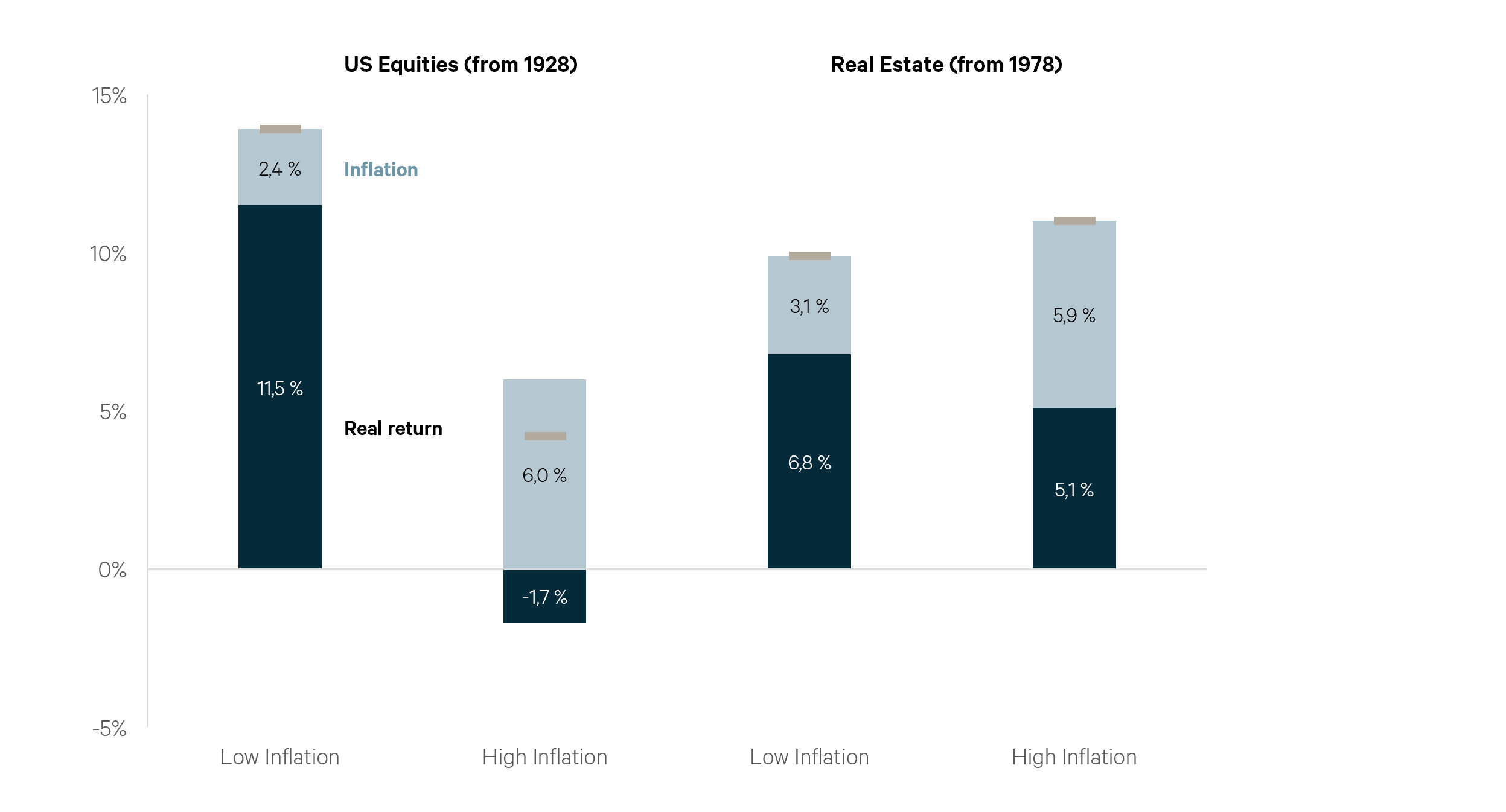

If we experience sustained higher inflation, are unlisted real assets less attractive? Not necessarily. In the US, real estate has provided a real return of 5.1 percent during periods of high inflation, according to KKR. Admittedly, it was even better during periods of low inflation (6.8 percent). However, in comparison, stocks have yielded a real return of minus 1.7 percent during periods of high inflation, down from 11.5 percent during low inflation periods.

If real estate has such excellent inflation-protective properties, why is it performing poorly at the moment, you might wonder? The yield for the best office buildings in Oslo has increased by 125 basis points, and all other properties have mostly experienced even higher yield expansion, in some cases perhaps as much as 200 basis points. Nominal values are down by almost 20 percent, while real prices have roughly fallen by around 30 percent. This can be deemed a significant correction.

The reason is that we have experienced a massive repricing of real interest rates, which also came from an artificially low level. The market will stabilize when property values reflect the new real interest rates. Consequently, many investors will have the pleasure of owning existing brick and mortar in an inflationary world if those predicting persistent high inflation are proven right. In the American capital market, inflation expectations are already back to just over two percent.

In the first half of the year, capital raised for new real estate funds globally was at the lowest level since 2013. However, it's not a complete halt. 70 billion dollars were raised, and if we include the existingly raised funds, there's a total of 418 billion dollars in dry powder.1 This is the highest level ever recorded. Therefore, some will continue to buy real estate in the future. However, there's little indication that investors are in a hurry right now.

1 Source: Preqin