Extremely strong market

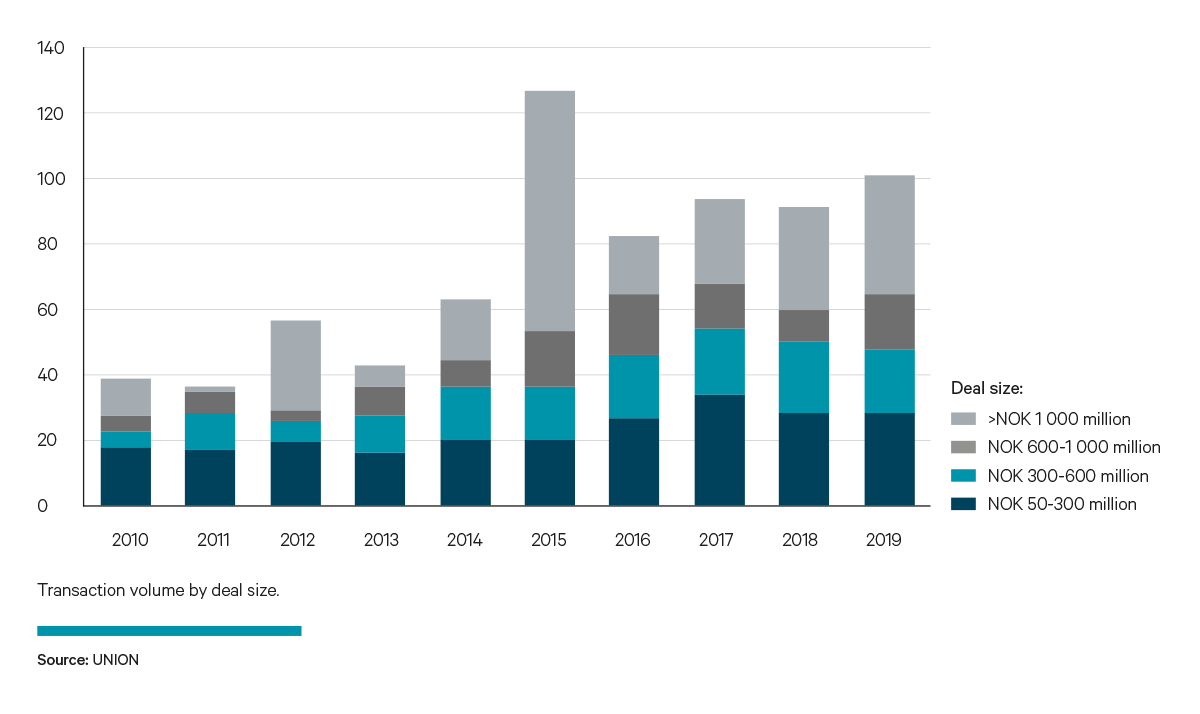

Liquidity in the transaction market is high, and no less than 318 properties changed hands for a total of NOK 102 billion last year.¹ The volume was only higher in 2015, when it was lifted significantly by a few large portfolio transactions. There were “only” 239 transactions that year. If both volume and number of transactions are taken into account, 2019 comes across as record-strong.

Club deals totalling NOK 26.3 billion were arranged for property, a rather lower level than in the two preceding years when the peak was reached in 2018 at NOK 31.5 billion. Including circumstances where an arranger acted as the purchase adviser or placed a property with a single buyer, however, club deal arrangers were involved in transactions totalling NOK 39.2 billion in 2019. That was on a par with the year before, and means that such players participated in about 40 per cent of the volume transacted.

A clearly growing trend has been evident in recent years for club deal arrangers to act more frequently as purchase advisers, or to place properties with a single investor. That development has probably been reinforced by the alternative investment fund (AIF) circular from the Financial Supervisory Authority of Norway (FSA). Many interpreted this document as imposing restrictions on opportunities for arranging property investments without being subject to the AIF regulations. One way of adapting to it has been to conduct transactions with fewer investors.

No less than 123 office properties with an overall volume of NOK 42 million changed hands last year. That represented a record for such sales. The biggest office transaction was DNB Livsforsikring’s acquisition of Midtbygget in Bjørvika for NOK 4.5 billion from Sweden’s SBB.

Many health-, education- and residential-related properties were also sold last year. These included purchases of day care nurseries totalling more than NOK 6 billion by Australian infrastructure investor Whitehelm Capital. The newly established UNION Core Plus Fund I acquired Pilestredet 35, with Oslo Met as the biggest tenant.

Interest in properties which can be developed for residential use remains high. In addition, several of the big housing developers also made structural moves. Selvaag Bolig sold its land bank to Urban Property for NOK 3.4 billion. The buyer is a newly established company owned by Selvaag AS, Oslo Pensjonsforsikring, Equinor Pensjon and Rema Etablering Norge. Selvaag Bolig will have a pre-emptive right and option to buy back the land, and the plan is to exercise these as housing projects progress. For its part, Solon Eiendom has acquired the Kruse Smith property division, where the land bank is valued at about NOK 2.3 billion. That gives Solon a solid foothold in southern and western Norway.

Veidekke is looking at the possibility of splitting its business in two, making the property development section a separate company which might perhaps be sold in its entirety.

In other words, a number of major transactions are in progress, and 2020 is likely to another year with a high level of liquidity in the transaction market. We expect the transaction volume to end up around NOK 100 billion.

¹ SBB’s acquisition of Hemfosa is not included in the volume. The Norwegian part of Hemfosa’s property portfolio amounted to almost NOK 10 billion.