It’s all down to yield

The transaction market for logistics properties has taken off over the past couple of years, with value growth escalating. No other segment has experienced such strong progress. But the whole value trend can be attributed to declining yields.

Typically, the best assets in this segment are now trading at a yield of about four per cent. Prime yield for logistics properties has thereby fallen by 75 basis points since January 2020, with more than half of the decline occurring over the past 12 months. By comparison, prime yield for offices has come down 35 bps over the same period and the trend has been flat for the past year.

And it is precisely the development in yields which has driven the value increase in this segment over several years. Viewed overall, rent growth has been virtually non-existent.

This trend contrasts with what we have seen in other segments. In the office segment, for example, periods of high value growth have often been driven by both rising rents and falling yields.

However, this phenomenon is not confined to Norway. MSCI reports that yield development has been the driving force in much of Europe. Average value growth in the big continental logistics markets over the past 12 months is 15 per cent, with only 1.6 percentage points deriving from rent increases. By comparison, German inflation is currently 4.5 percentage points (annual rise to October).

According to Savills, the gap between prime yield for Norwegian logistics and office properties is the widest in Europe. This differential has disappeared in both London and Dublin, and the same is occurring in several major European cities. In the British Isles, however, rent levels are seen to be rising.

Unsurprisingly, the high level of demand from investors has resulted in an extremely active transaction market. So far this year, we are aware of 80 transactions in the logistics, industrial and mixed-use segment, with a combined volume of about NOK 29 billion.

That volume includes Asset Buyout Partners, acquired by Balder Fastigheter for NOK 9 billion. Looking at pure logistics properties alone, transactions amount to about NOK 12.8 billion spread over almost 40 deals.

The market for logistics properties is relatively small. Estimates indicate that logistics buildings representing more than 15 per cent of the total market value of such assets in Greater Oslo have changed hands so far this year.

The corresponding estimate for the office market is about five per cent, including Entra’s acquisition of Oslo Areal – which accounts for about half the office volume.

High investor interest is being driven by several factors. The pandemic has largely colluded with the market, since increased purchases of goods and accelerated growth in online shopping have been important demand drivers for logistics premises.

This trend has created expectations of a growing need for space, with associated rent rises. Many have also viewed the segment as a safe haven at a time when uncertainty is periodically high in such segments as offices, retail and hotels.

Central areas filling up

Growth in demand for logistics space is likely to persist in coming years, with online shopping expected to remain a substantial driver. Virke, for example, expects a growth of more than 10 per cent in coming years.

Viewed in isolation, this will probably help to increase demand for space by 40-50 000 m² per annum up to 2025. But it must be borne in mind that, since growth in online shopping cannibalises turnover from bricks-and-mortar stores, the demand impulse from this trend will be weaker than it would otherwise have been.

As demand for space rises, more and more established logistics areas are filling up. One case in point is Berger, and another is the logistics cluster in Vestby.

Large parts of the latter have been developed since 2010, and the supply of new sites with planning permission in place is now limited. However, the local authority recently took action and launched the planning process for a further 22.3 hectares as a new addition to the industry park.

Looking at the best-established logistics clusters with central locations in Greater Oslo, a reserve of just over 100 hectares has completed planning.1 Roughly speaking, that means it is possible to build 500-600 000 m² of new logistics space in this area.

Moving further out from Oslo, the supply of sites is substantially greater. The Gardermoen Industrial Park being developed east of the airport is a good example, and covers more than 500 hectares.

With its 115 hectares, Oslo City Airport (OAC) ranks as the biggest landowner in the area. According to the company’s annual report for 2020, current local plans permit the establishment of 600 000 m² in new logistics space. In addition, large parts of the acreage belonging to other landowners will probably be developed for logistics.

We regularly see examples of Gardermoen luring attractive tenants from other areas – most recently when it became clear this autumn that the Sport Holding group would establish a new main warehouse totalling 35 000 m² there.

Three-pronged rent trend

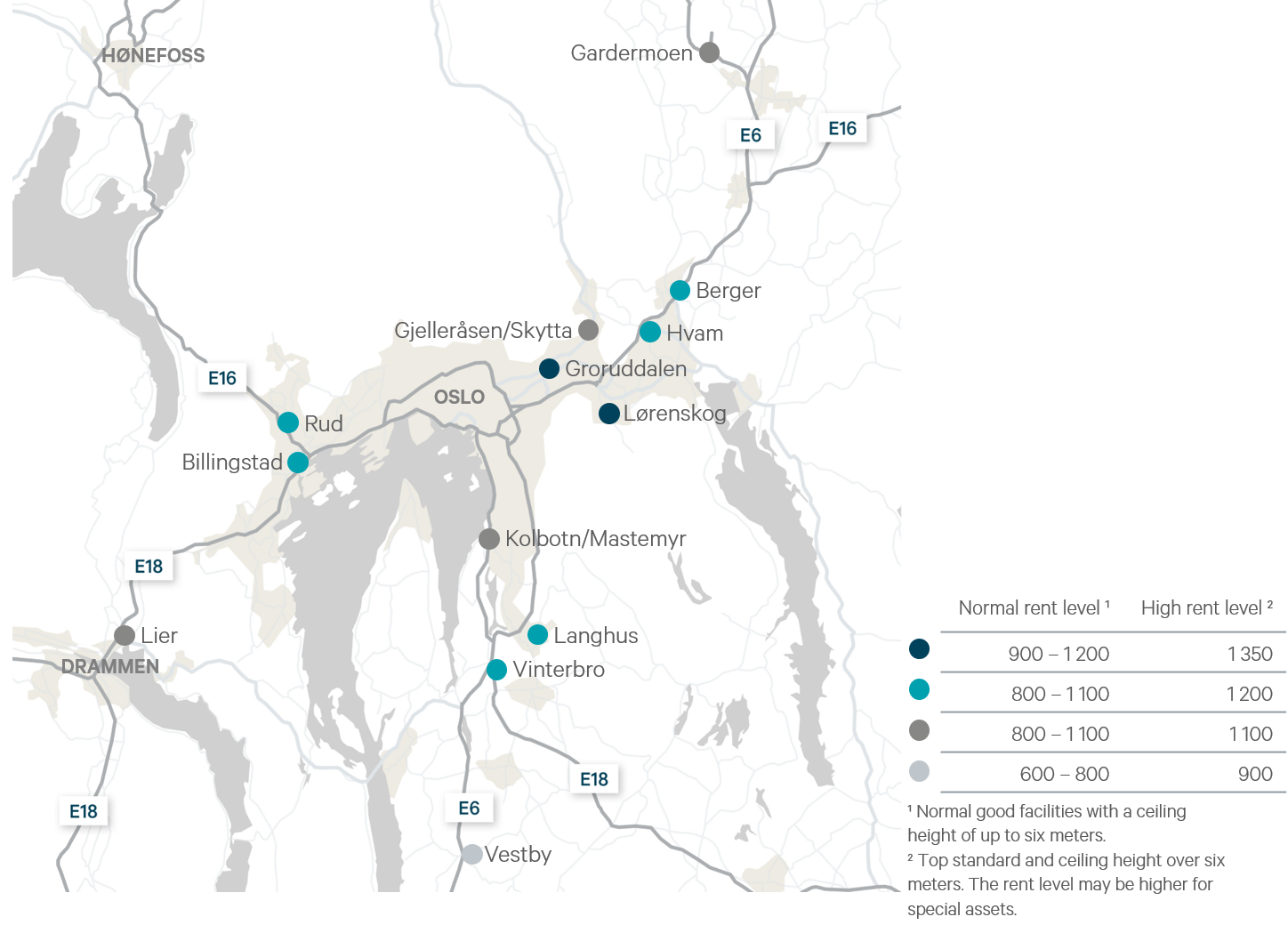

Roughly speaking, we see a three-pronged trend for rents. In central Groruddalen, where demand for warehousing and mixed-use buildings is growing and the net supply of acreage has gone into reverse, prices are clearly rising.

Where attractive areas along the motorways are concerned, such as Berger, rent levels remain stable. Moving further out, rents have come under weak downward pressure.

The combination of much land and declining yields contribute to that. Construction costs are now on the way up, which could help to moderate this trend.

Looking ahead, we expect rents to continue rising in Oslo, and that this growth could also spread to the best areas outside the city limits. Where the rest of the market is concerned, we by and large expect rent levels to remain stable.

1 This embraces the logistics clusters outside Oslo’s city limits, with Kløfta in the north, Vestby in the south-east and Lier in the south-west.