Demand high, transactions few

In our market report for the autumn of 2019, we described a slow start for the transaction market in the warehousing, industrial and logistics segment after record activity in 2018. This tendency persisted to the end of the year, and we count a total of 55 transactions with a combined volume of about NOK 13.4 billion. By comparison, the 2018 figures were 78 transactions totalling more than NOK 23 billion.

Transaction market

Despite the moderate level of activity, several interesting properties changed hands. A club deal arranged by Arctic Securities acquired Kongsberg Teknologipark for NOK 3.1 billion before the summer. This transaction alone accounted for more than 20 per cent of the total volume in the segment during 2019. It later became known that Danish logistics company DSV had acquired an 11-hectare site at Vestby in order to build 55 700 m² of warehousing, terminal and offices.

The decline from the year before, and the relatively low 13 per cent share of the total transaction market, did not reflect any lack of interest in the segment. Rather the opposite – the growth in demand we have witnessed in recent years has largely been driven by attractive cash flows combined with a positive trend in the rental market because of expanding online shopping. With the latter still expanding and with low, stable interest rates, we believe demand will remain high.

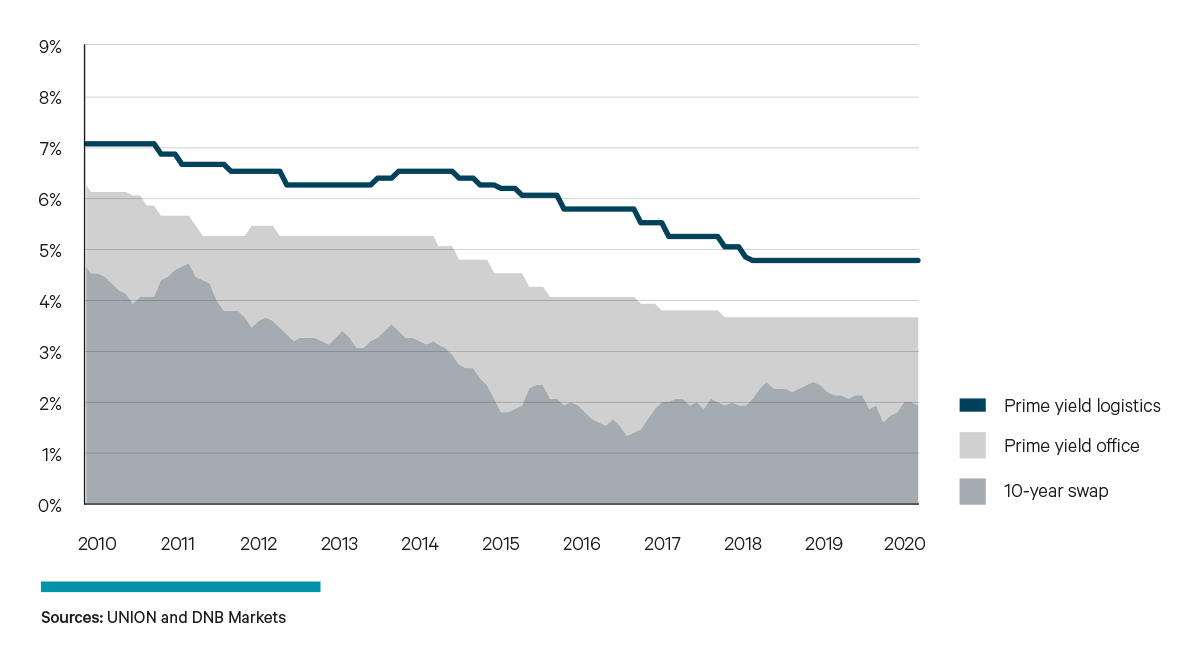

We find instead that the moderate level of activity reflects the limited number of attractive objects for sale. This could be to some extent a natural consequence of the many transactions conducted in 2018. Our estimate of prime yield for warehousing and logistical properties is unchanged at 4.75 per cent.

Rental market

With online shopping now part of daily life for most Norwegians, space requirements in the logistics segment are heavily influenced by demand for goods via the web. Online shopping typically requires three times more logistics space than traditional retailing.¹ Higher growth in real incomes and increased employment will probably help to boost private consumption in the time to come, which is likely to benefit online shopping. In other words, many signs indicate rising demand for logistics space.

The expansion of e-commerce is paralleled by steadily growing concerns about the climate. Environmental measures in the logistics sector are constantly been written about, and everything from fuels to waste sorting and energy consumption is frequently mentioned by big players such as Asko, the Norwegian Post, Bring, DB Schenker and PostNord. A natural extension of this is to incorporate the buildings used in the environmental strategy, which will make bigger demands on landlords. It is no coincidence that 2019 was the year when Bulk Infrastructure became the first owner of a Norwegian industrial building to secure Breeam certification. We think more cases like this will be seen in the time to come.

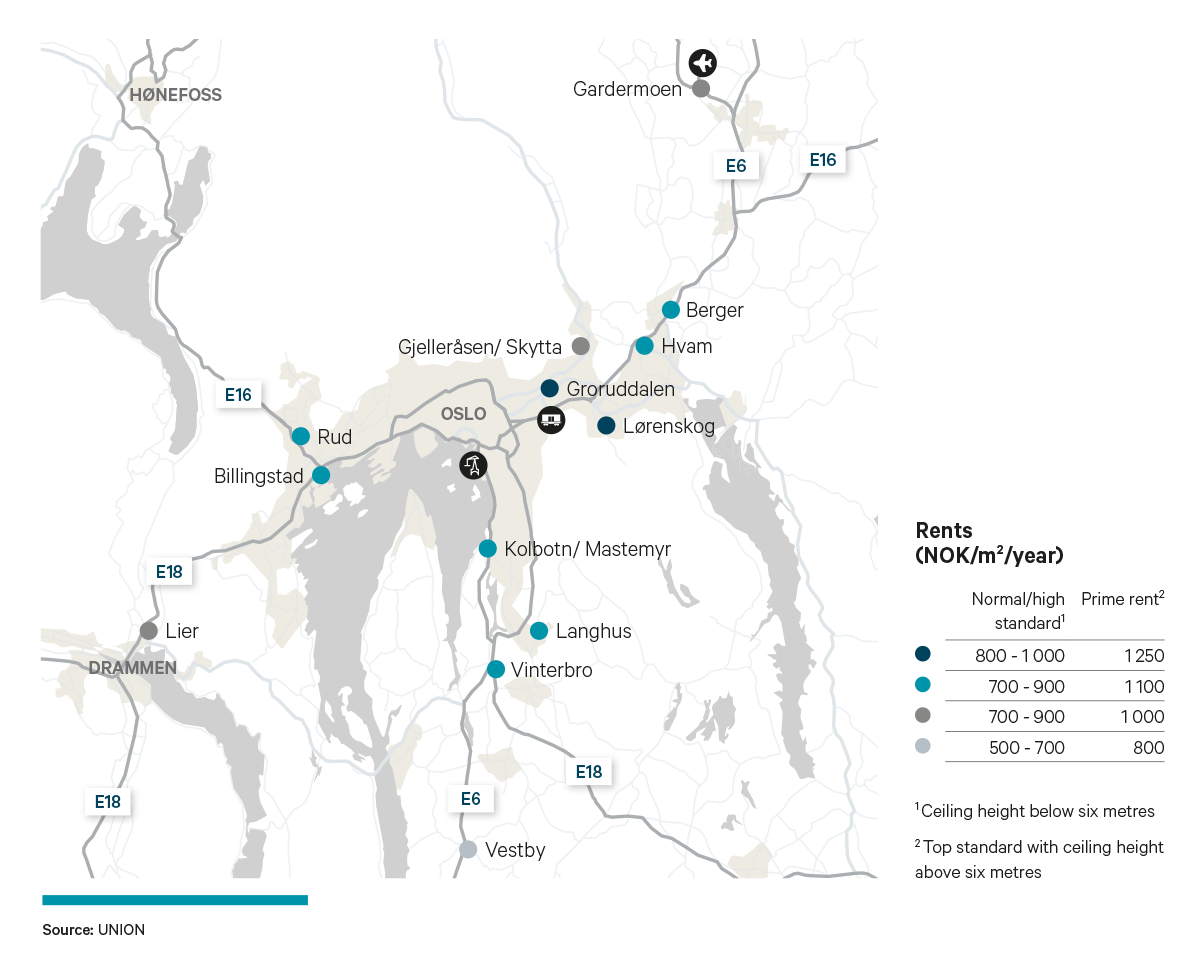

It is important to distinguish in this segment between smaller warehouses and mixed-use properties on the one hand and large logistics buildings on the other. The latter are characterised by a relatively limited number of tenants who enter into large leases with a long time frame, and volume discounts are often secured. Many attractive sites are still to be found along the motorways, so that tenants who do not need to be positioned in the immediate vicinity of the city have plenty to choose between. A combination of good availability of sites, short construction times and yield compression has helped to keep prices down, despite increased demand for space. Real rents have accordingly shown a slight decline in recent years.

A number of minor and medium-sized tenants are often found in small-scale warehousing and mixed-use properties. They are frequently looking for warehouses, showrooms, cash-and-carry premises and offices, or a combination of these. Such players are often enterprises which depend to a greater extent on the local population and want to be close to the city centre. The biggest market for warehousing and mixed-use properties is found in Groruddalen on Oslo’s north side. A substantial proportion of such properties lies in the development areas which the City of Oslo has incorporated in its planning strategy, and which will probably be converted to other purposes in the long term. In addition, new buildings of this type seldom are seldom constructed within the city limits today.

¹ Source: Prologis.