Weak exchange rate gives strong hotel market

Ten hotel properties changed hands in Norway during 2019, with a combined asset value of roughly NOK 3.1 billion. That represented two fewer than the year before. The turnover volume was NOK 600 million above both the 2018 figure and the annual average of NOK 2.5 billion in 2010-18.¹

Transaksjonsmarkedet

These transactions were evenly spread between the biggest cities and smaller places in the rest of Norway. Storebrand Eiendomsfond Norge KS, for example, has acquired Scandic Helsfyr in Oslo from Eiendomsspar for NOK 1.1 billion. This hotel is being expanded by 200 rooms to provide 450 in all by 2020. Acquisitions in smaller places include Norwegian Hospitality Group’s purchase of Farris Bad in Larvik from Canica Eiendom.

Our estimate of prime yield remains unchanged at 3.75 per cent.

Rental market

Overnight stays in Norway rose for the sixth year in a row during 2019. Just over 25 million overnight stays were registered in Norwegian hotels, up by 5.5 per cent from 2018.² The weak krone exchange rate has made Norway cheaper for tourist stays. These showed the biggest rise in demand, up by 7.7 per cent, while growth for business travellers was 4.3 per cent.

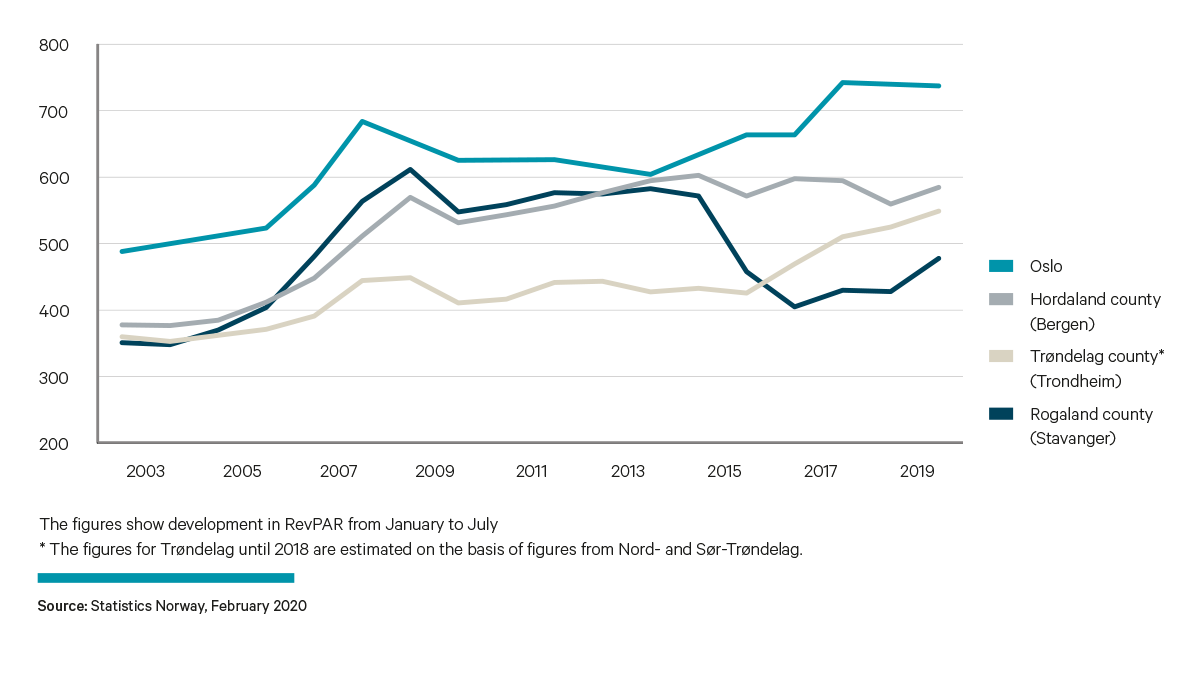

On a national basis, occupancy rose by 0.5 percentage points to 55.8 per cent in 2019. Prices were up by 2.5 per cent. Rising room rates and higher occupancy increased revenue per available room (RevPar) by 3.4 per cent. That represented substantially stronger growth than in 2018, when RevPar climbed by 0.4 per cent.

Oslo experienced a particularly high growth in demand. Overnight stays rose by 10 per cent in 2019, with tourists accounting for 16.2 per cent of the increase and business travellers for 5.7 per cent. Courses and conferences declined by six per cent.

Despite the strong growth in demand, RevPar fell by 2.9 per cent in the capital. The probable reason was several new hotel openings during 2019. Clarion Hotel The Hub and Amerikalinjen at Oslo Central Station reopened after renovation, for example. Clarion Hotel Oslo in Bjørvika also opened with 255 room. These three alone added almost 1 250 new hotel rooms to the market. A total of 1 710 new hotel rooms were opened 2019, corresponding to a growth of 12.7 per cent. The growth in room numbers is expected to slow in the time to come. That therefore lays the basis for an increase in RevPar.

Last year’s strong trend in the Stavanger region is continuing. Room occupancy and prices both rose substantially last year, with RevPar up no less than 11.7 per cent in 2019. Demand has increased on several fronts. Occupancy increased by 24.3 per cent for tourists and by 13 per cent for business travellers. Although hotel-market developments in Norway’s oil centre are very positive, RevPar remains 18 per cent down from the 2013 peak. Moderate growth on the supply side is expected in the time to come, so conditions are right for the positive development to continue.

The increase in RevPar for the Bergen region was 4.5 per cent in 2019. In other words, the market is recovering after a RevPar decline of 5.9 per cent in 2018. The course and conference segment has seen the largest increase in demand, at 13.5 per cent. After big growth on the supply side, with an increase of no less than 29.4 per cent in new hotel rooms over the past five years, moderate expansion in supply is now expected over coming years. That lays the basis for maintaining the positive trend.

RevPar in the Trondheim region is continuing to rise, and was up by 4.6 per cent despite a 10.9 per cent increase in supply. At 6.8 per cent, tourists accounted for the biggest increase in demand. Growth in hotel rooms is expected to be moderate in the time to come, so that the market will be in relative balance.

¹ Source: UNION.

² Source: SSB.