Conversion wave building

But it will be different from the ones we have seen before, because we have seldom experienced changes in so many sectors simultaneously.

Written by head of research Robert Nystad. The article was published in Kapital on April 29, 2021

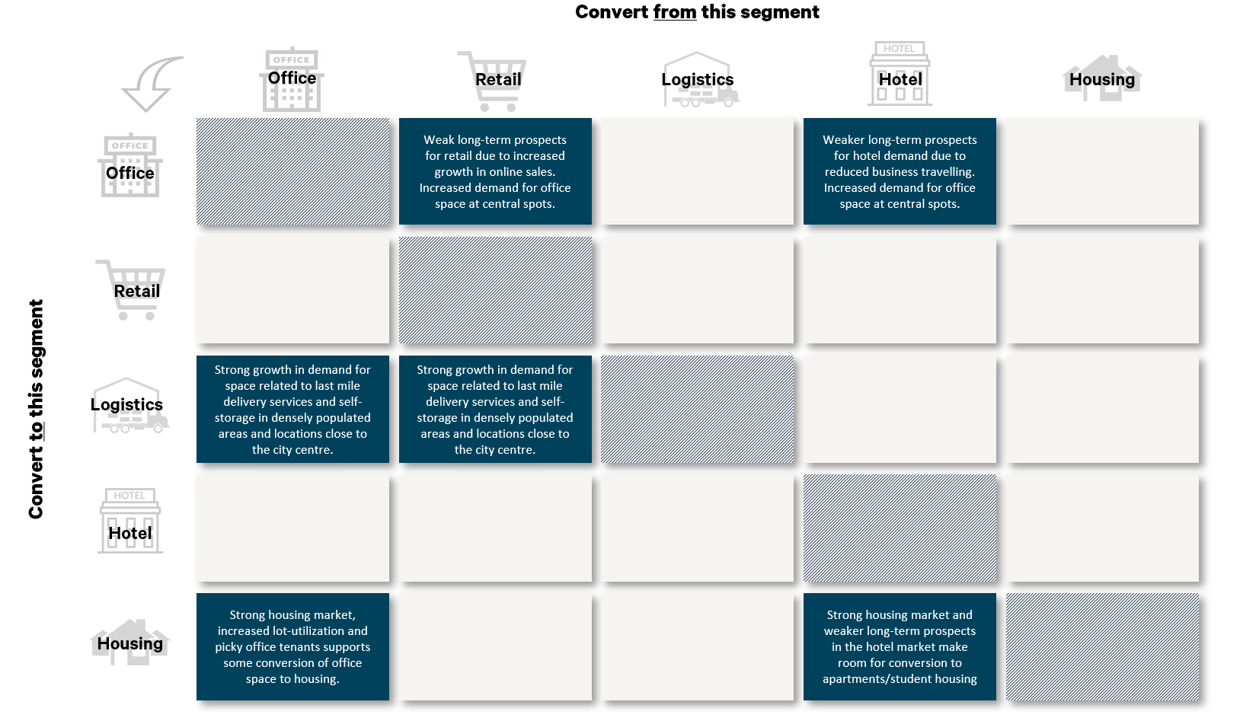

When we have earlier talked about conversion, this has normally involved turning offices into homes. That has typically been driven by a strong housing market and more demanding office tenants. Many outdated office buildings have had to give way to new residences.

We will certainly see further examples of such conversions in the future as well, but not to the same extent as in the previous period of strong residential price growth in 2015-16. For that, there are too few office buildings that are profitable to convert, because many of the obvious candidates have already been converted.

This time, however, the conversion will go in many other directions. We have long seen declining demand for retail space in the city centre. At the same time, we expect that office-based companies will continue to prefer central locations and – at today’s pricing – that more retail space will probably be eventually converted to offices.

Some would maintain that office tenants will cut down on space because of an increase in remote working. In that event, they will have an even stronger incentive to choose a central location for their headquarters.

Certain hotels must also give way. We will see some being converted to offices while others become flats or student bedsits. That does not mean the hotel market will not recover, because it will, but not quickly enough to prevent the least profitable disappearing along the way.

Then we have an outrider in this context – namely warehousing. No other segment is experiencing faster growth in demand for new space. It can be divided into three sub-categories. The first is traditional logistics buildings, where big changes are occurring in terms of automation but which will remain concentrated along the motorways outside Oslo. Conversions are likely to be limited here, but newbuilding should be substantial.

Second come the “last-mile delivery” players, where location is exceptionally important. A good position will be one able to reach as many households as possible in the shortest possible time – such as a central site in Oslo’s Groruddalen district. In some areas, we will see players of this kind possibly competing with both office and retail tenants over willingness to pay, which will contribute to conversions.

The third category is the expansion of another niche – namely mini-warehouses. Players here are eating up space. We saw an example of this just before Easter, when it became clear that Fornebuveien 40 was to be converted to storage units. This 8 300 m2 office building will accommodate more than 1 000 of them. Ferncliff’s new Second Space concept is leasing the building.

A certain dynamic naturally always exists in the way property is utilised, but we seldom see the changes in so many sectors at once that we do now. This lays the basis for thinking innovatively about how to maximise property values. In some cases, buildings are converted because their value has fallen. Where others are concerned, the alternative value has increased. What is in any event certain is that possessing properties in locations which can work for several different applications offers a clear advantage.

We are in a time of transition, where a lot is changing. That creates uncertainty, and some players will have to take a loss. But it also offers exciting opportunities for able property managers.