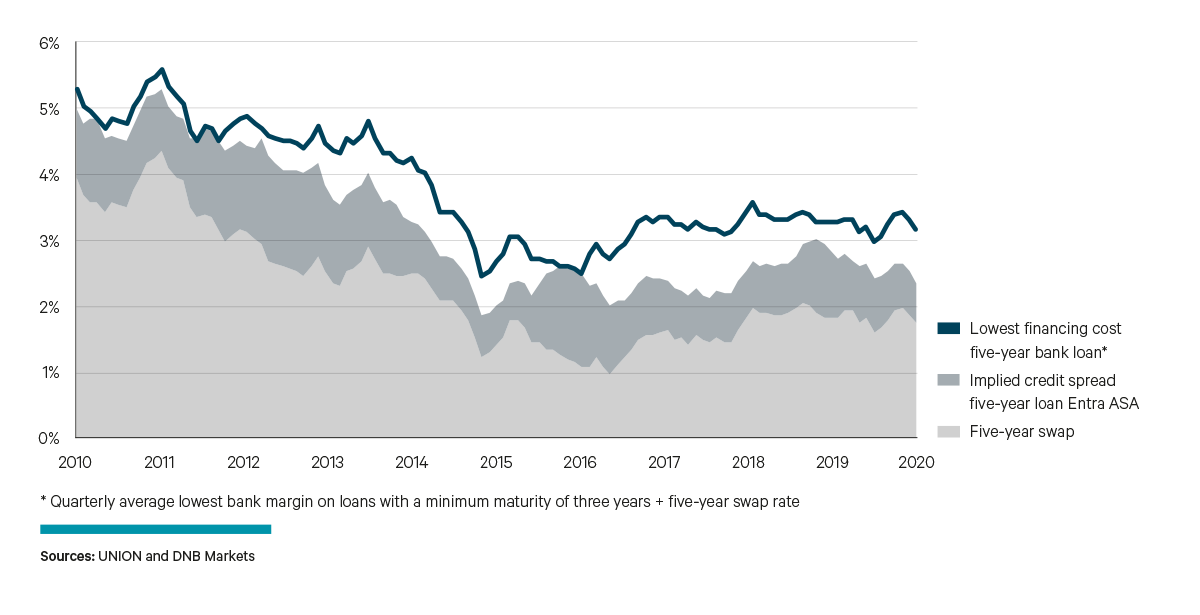

Credit spreads in decline

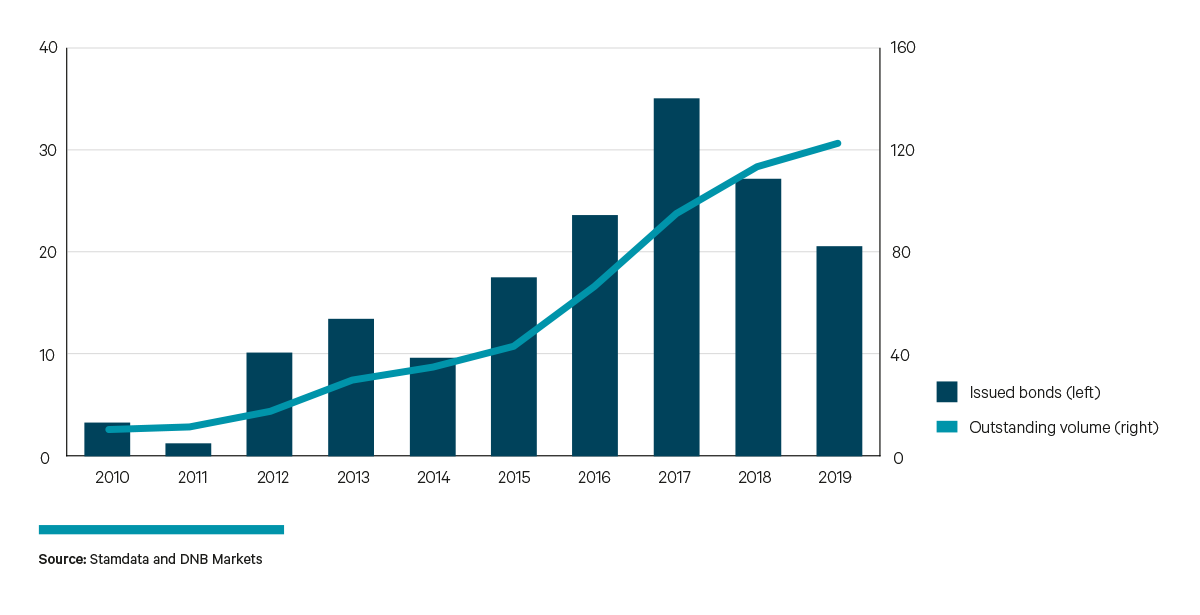

New property bonds totalling NOK 20.6 billion were issued in 2019 – the lowest volume seen since 2015. However, the spread in the cases being financed through the bond market last year was large. About half the volume of bond issues in 2019 was classified as high yield. By comparison, only 15 per cent of the volume was high yield in 2014-18.

The growth in the volume of outstanding bonds – which was explosive during 2011-18 – is flattening out. That reflects an ever larger proportion of new issues to refinance bonds issued in recent years which have now matured. The bond market currently accounts for an estimated 15 per cent of total debt in Norwegian commercial property.

Investors were relatively risk averse in early 2019, and credit spreads had widened a good deal. Today, a lot of capital is available in the markets and much has flowed into both Nordic and Norwegian funds. Not since 2014 have Norwegian fund managers raised as much money as they did in 2019.¹ At the same time, the relatively high proportion of new bond issues related to refinancings meant there was little net growth in new debt to invest in.

In other words, the supply of bond investments is limited while demand is high. That has contributed to attractive terms for issuers.

The narrowing credit spread in the bond market naturally also benefits the property companies. A five-year Entra bond now has a spread of 60 bps, 18 bps lower than in mid-September and 50 bps below the level a year ago.² The spread is also low from a historical perspective. The lowest level recorded since the financial crisis was 56 bps in the second quarter of 2015.

Increased fears over the coronavirus, lower global growth and turbulence in financial markets could naturally help to widen credit spreads in the course of the year, particularly for high-yield bonds. But credit markets have stayed in remarkably good condition so far, and it does not look at the moment as if we will experience very substantial movements in spreads for quality bonds.

¹ Source: DNB Markets.

² Source: DNB Markets, at 19 February 2020.