Debt - How Big Will the Problem Be?

Many years of sharply declining yields and rising property values have been replaced by inflation and interest rate shocks. Interest rates and rate expectations have also increased significantly in the last two months. How many will run into trouble?

Since spring 2021, the total loan cost for new loans has more than doubled, from around 3 to 6.5 percent, depending on loan-to-value (LTV) ratio, maturity, and interest duration. Market rates have surged just in the last two months. And as it looks now, there's unlikely to be any improvement in the next few quarters.

Could what's happening lead to a larger debt crisis? Four factors are likely to be crucial.

-

How much will property values fall? This will impact the need for new capital and, most importantly, how many will be forced to sell. Few forced sellers and low liquidity dampen the rise in yields.

-

How will cash flow handle the new interest cost? In other words, property owners' liquidity and ability to pay interest. If you don't have enough rental income to cover interest payments, trouble arises. It's hard to service the loan with bricks, and banks are particularly concerned about cash flow.

-

How will access to debt evolve? So far, the debt market has worked well for refinancing. It has become significantly more expensive, but the banks are still there. Nevertheless, the debt market is fragile, and capital could become scarce going forward.

-

How will the rental market develop?

If the decline in market values roughly matches our expectations, many will face challenges, but the situation will generally be manageable. According to our own bank survey, the majority of new loans have had around 60 percent LTV in recent years. With a decline of between 10 and 20 percent in property values from their peak, the new debt ratio in many cases will be between 66 and 75 percent. However, many have effectively had a lower debt ratio than 60 percent because they have made repayments and seen value increases prior to the downturn.

Syndicates are often considered the weakest link, meaning they will likely be the first to crack when the market hits a wall. Facilitators have been aggressive in a hot transaction market for many years, and they are mostly organized in SPVs.

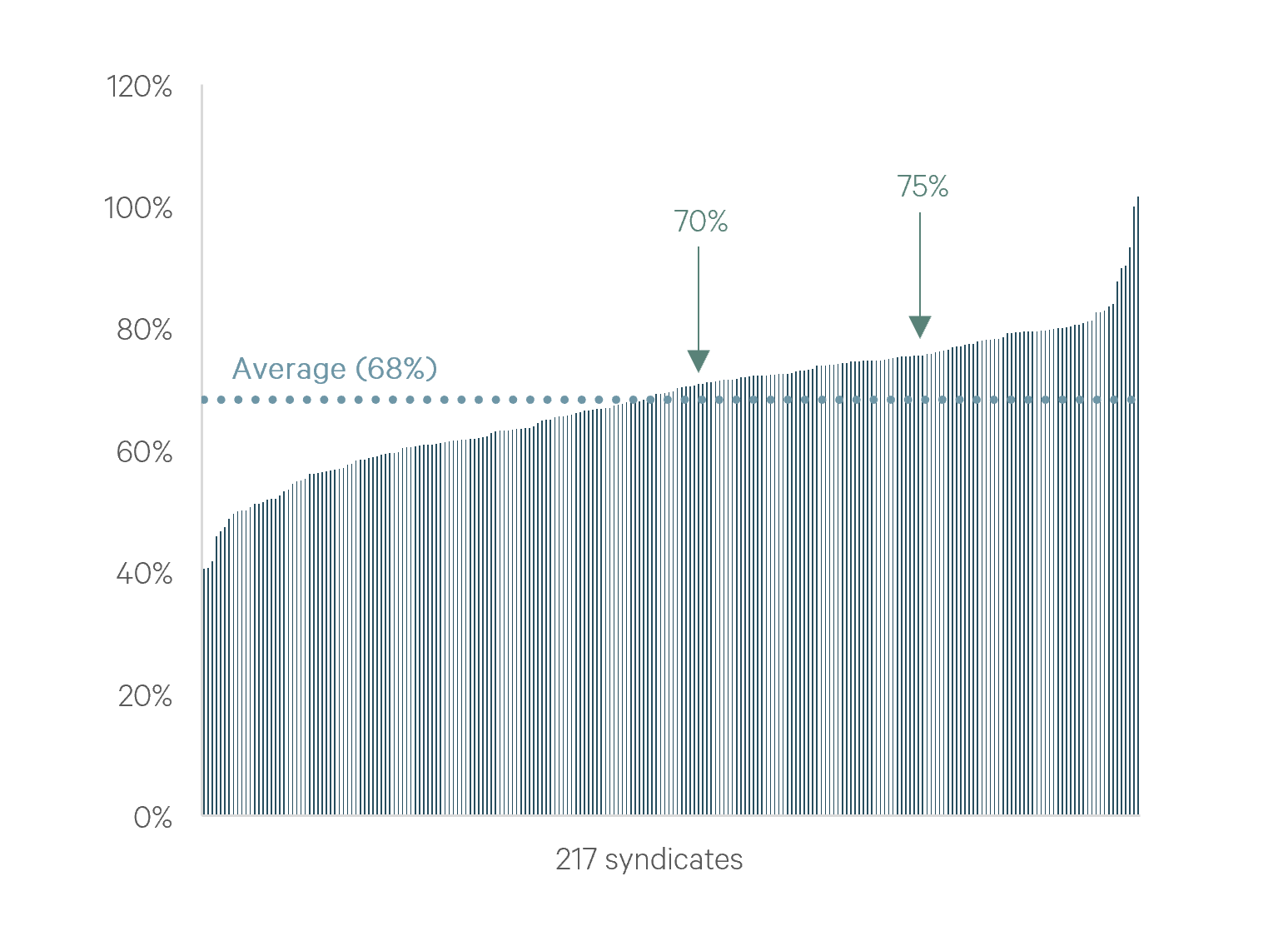

However, syndicates are not particularly highly leveraged. The debt ratio was on average 57 percent at the last valuation. Many likely undervalued their properties so far. With a 15 percent drop from here, the average LTV in syndicates will rise to around 70 percent.

But not everything is about averages. There is significant variation behind the numbers. With a 15 percent value drop from current levels, a significant portion will end up (i) above the 70 percent LTV typical cutoff where dividends can't be paid, and (ii) above the 75 percent LTV where more equity must be raised.

What About Cash Flow?

Let's return to syndicates as a starting point. The average yield in the syndicates at the last valuation was 5.8 percent, based on 2023 rent. Assuming 5 percent growth in CPI this year, the running yield will increase to 6.1 percent next year.

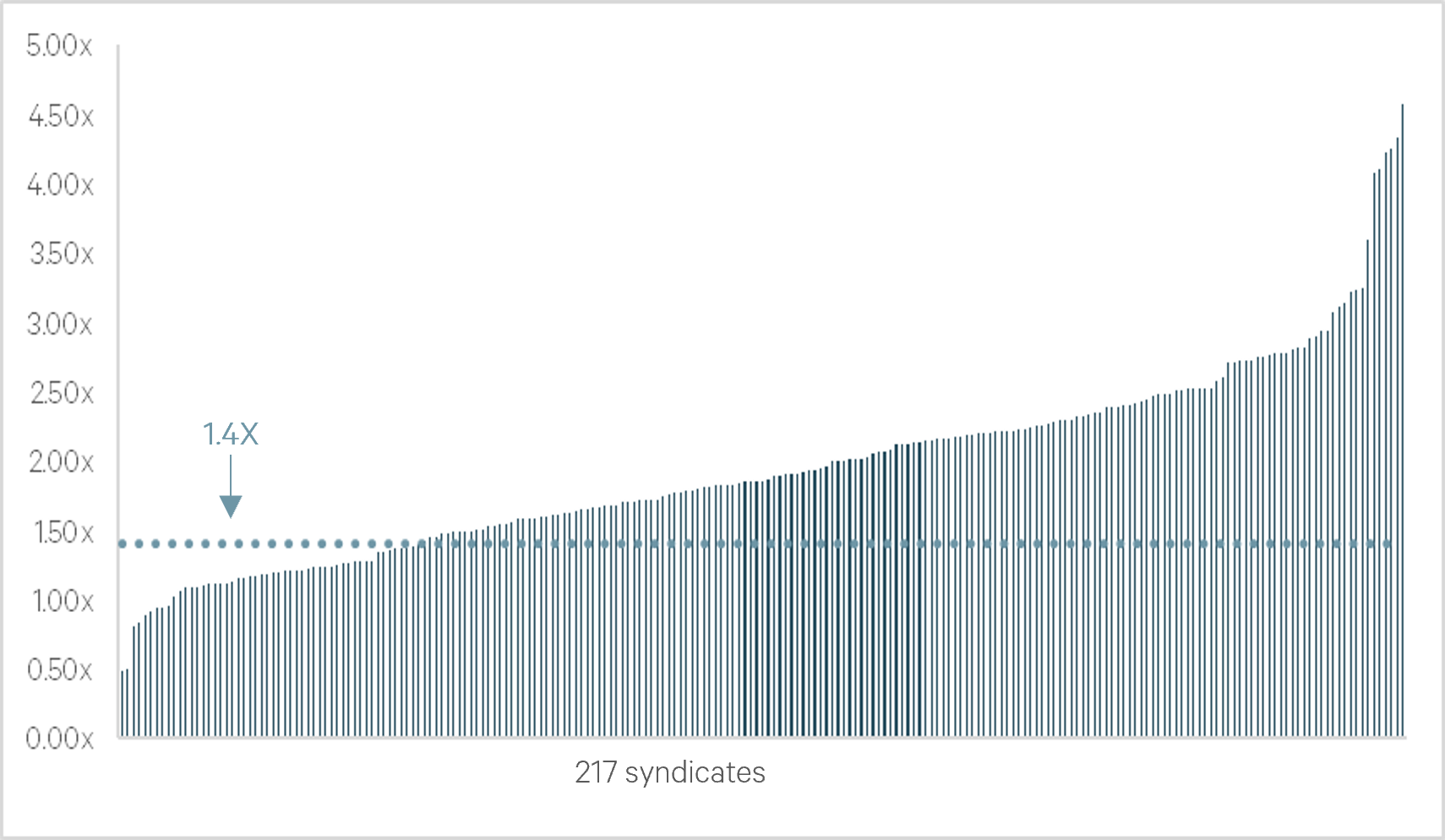

In the chart below, we have set up the interest coverage ratio for 217 syndicates. Here we assume a 3-month NIBOR of 5.0 percent and a credit margin of 250 basis points.

As seen from the graph, nine syndicates have an interest coverage ratio below 1.0x, meaning they are not able to cover interest payments. Another 18 syndicates will then have an interest coverage ratio below 1.2x, while the majority will not have problems with repayment.

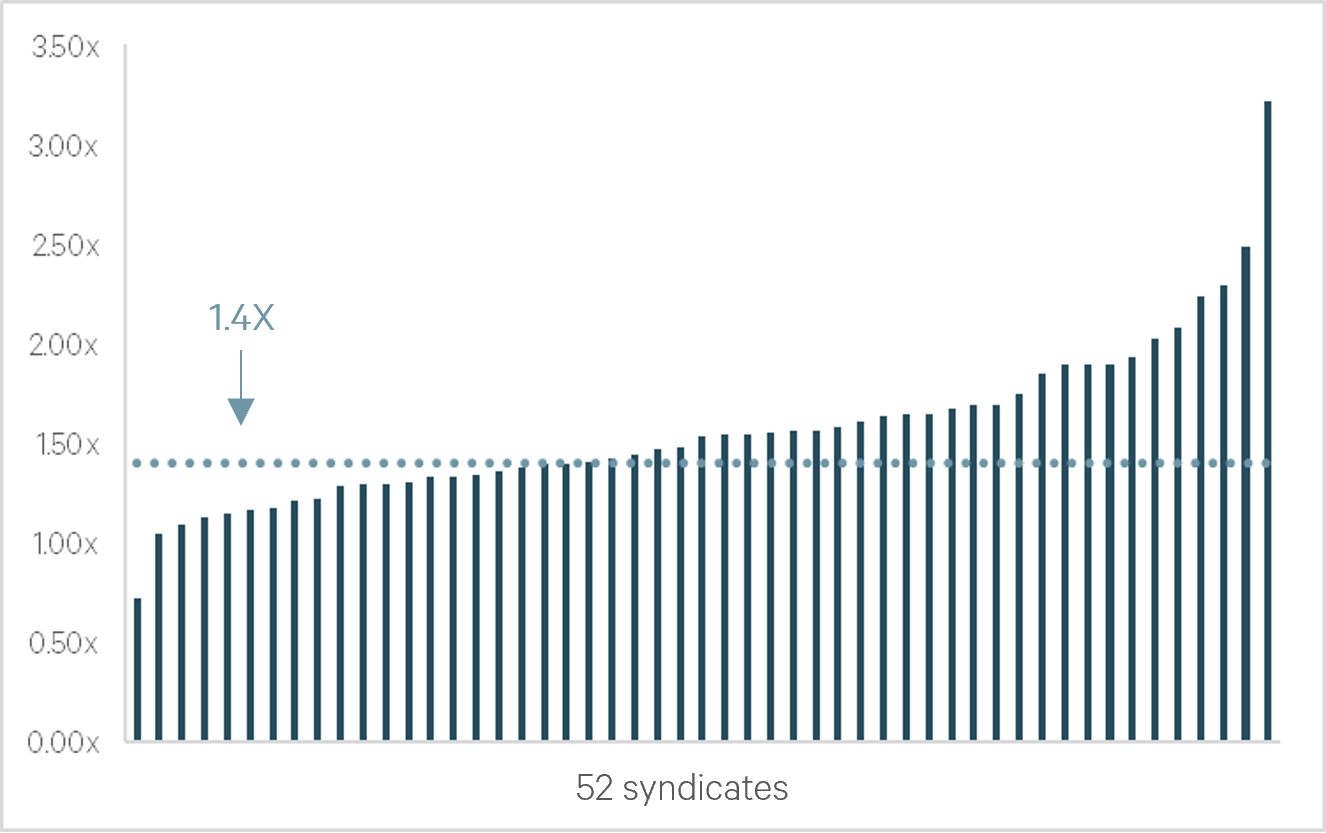

The interest coverage ratio is often upheld by the fact that many have fixed interest rates. A total of 35.7 billion of the debt in syndicates is at a fixed rate, equivalent to 65 percent. About 11.7 billion across 52 different syndicates mature in 2023 and 2024. The question then is what happens when they need to refinance? We have stress tested these loans. In the stress test below, we assume that the fixed rate agreements are replaced with floating rates under the same terms as above.

Eight of these syndicates have an interest coverage ratio below 1.2x upon refinancing. The above graphs indicate that the vast majority of syndicates will be able to service their loans, even assuming a money market rate of five percent. However, it will still be tight for many.

According to our own bank survey, the share of fixed interest rates in the market has generally been around 50 percent since the beginning of 2020. So, syndicates have fixed their rates to a greater extent than the overall market.

The Most Resilient Own the Lowest Yields

Properties and portfolios with low yields are vulnerable when interest rates rise as rapidly as they are now. After all, it's rental income that services the debt. Therefore, it's relevant to look at who owns the lowest yields in the market. Typically, this leads us to the CBD, Bjørvika, and the city center. There are three groups that stand out as major property owners in these areas:

-

Solid property companies: Norwegian Property, Eiendomsspar, Pecunia, Braathen Eiendom, Olav Thon, Ferd Eiendom, Höegh Eiendom, and Entra, to name a few.

-

Life and pension companies: KLP Eiendom, DNB Næringseiendom, and Storebrand Eiendom, to name the largest.

-

Unleveraged funds: DEAS, Malling, and UNION, among others, have such funds.

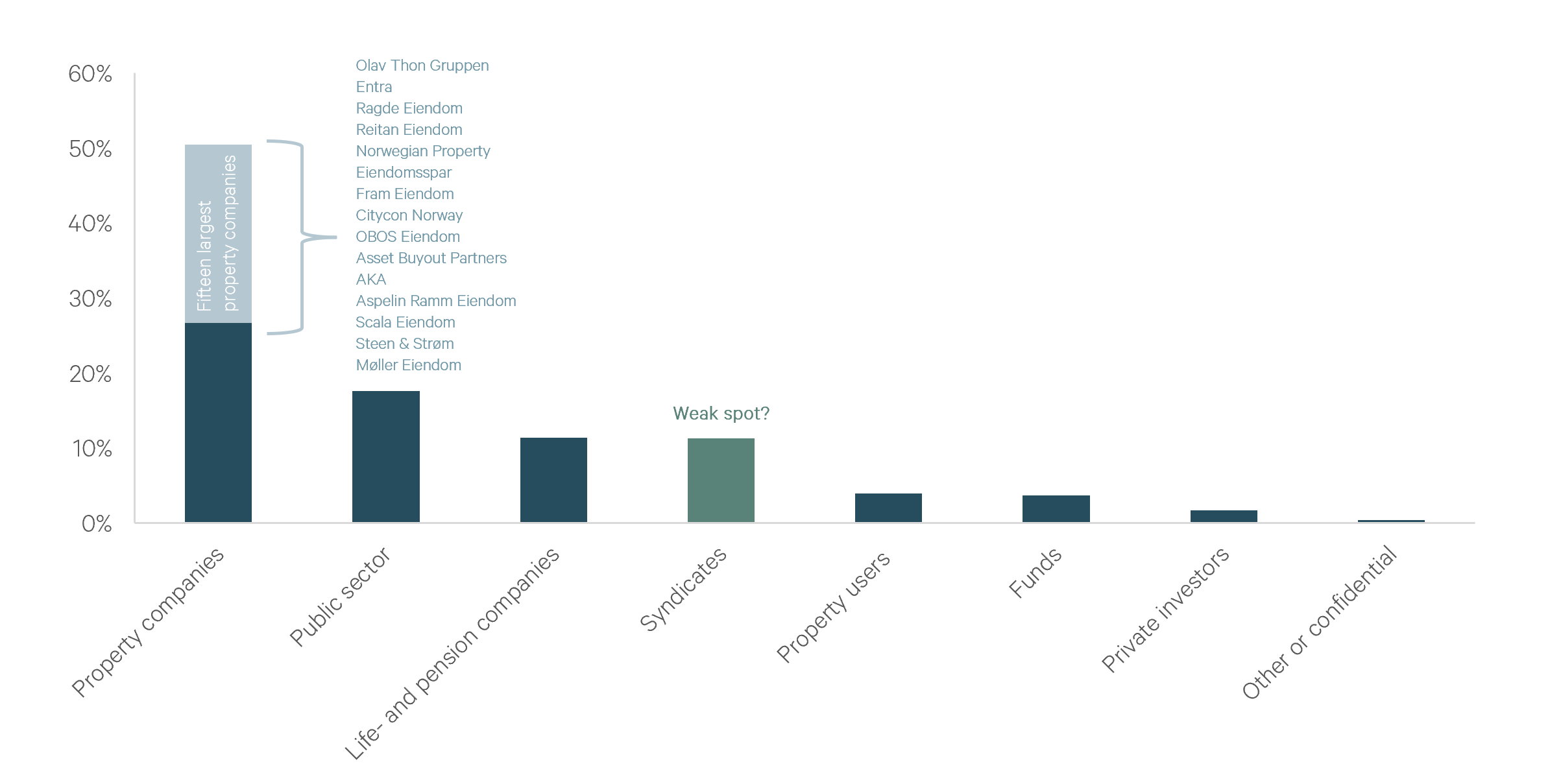

These are actors that generally have a strong balance sheet or are unleveraged, and they are likely to withstand the current situation. If we look at the 250 assumed largest property players in Norway, unleveraged property constitutes 11 percent and public entities 18 percent. Property companies in all facets make up about 50 percent, of which a large share again are the top fifteen.

Access to Credit Becomes Crucial

Even in a situation where most are able to manage their debt, there could be issues if the capital market doesn't function properly. There's still a significant risk that debt could become a scarce resource:

-

The bond market is very slow. This year, approximately 28 billion NOK worth of property bonds will mature, while only 6.3 billion NOK worth of new bonds have been issued so far this year. If the activity in the bond market doesn't pick up significantly, it means that much will need to be refinanced in the bank (or paid off).

-

Life insurance companies still have a low appetite for property debt. Life insurers have been major takers of bond debt, but they have also been an important source of capital through investments in syndicated bank debt.

-

Banks face increased credit risk in their own portfolios. The major banks use IRB (Internal Ratings-Based) models, which means, among other things, that the banks' capital requirements are determined by the risk of their loan portfolios. When the key indicators of the loan portfolio weaken, banks will likely have to hold more equity behind existing loans. The consequence would be a reduced lending capacity and higher costs.

-

Nordic (Swedish) banks account for around 37 percent of the lending volumes in the Norwegian market. What happens in Sweden will impact the debt market in Norway.

Despite many factors pulling in the wrong direction, there are also strong arguments that the debt market should function during the tough period we are currently in:

-

Banks are generally well capitalized.

-

Rising interest rates are, in isolation, good news for the banks, as they can earn more money on deposits. Both analysts and the banks themselves predict high profitability in the banking sector in the years to come.

-

Debt is being repaid continually, typically between 1 to 2 percent in repayments per year for commercial properties. Construction loans are repaid much more quickly, and with few new starts, banks free up capital.

-

There is good reason to assume that demand for loans on a general basis (credit growth) will be lower if/when we enter a recession.

-

Banks are not interested in exacerbating the downturn.

Nevertheless, it is wise to assume that debt will be a scarce factor in the upcoming quarters.

Increased Cash Flow Dampens the Downturn

It's difficult to predict inflation, even a few months ahead. At the moment, however, there are indications that we could see a new CPI adjustment of around five percent in the autumn. In that case, we would have two CPI adjustments totaling around 12 percent over twelve months.

In addition, market rents in Oslo have increased significantly over several years. The Norwegian Central Bank has calculated that a typical property company that owns office space in Oslo will increase its top line by 20 percent from 2021 to 2024. Such an increase in rent equates to an immediate 80 basis points increase in the running yield. This naturally helps to mitigate the decline in value and improve cash flow.

However, there is a risk that we could be heading into tougher times in the rental market. In such a scenario, it's likely that the worst pressure on rents will ease, as a weak rental market is a symptom of a weak development in the Norwegian economy. The worst-case scenario is a combination of poor macroeconomic conditions and interest rates that don't rebound significantly. However, we consider this scenario to be relatively unlikely.

Summary

The cost of borrowing has increased dramatically, putting pressure on both property values and the ability to pay off debt. In most cases, however, individuals will still be able to service their loans. Sensible debt ratios, interest rate hedges, and increasing rental income mitigate the pressure.

Despite many actors being robust, some will need to balance on a knife's edge in the coming quarters. For instance, several syndicates risk reaching debt levels that approach breach of soft or hard covenants. In some cases, this could halt dividends and lead to stock offerings. Those with a combination of high debt ratios, limited interest rate protection, and low yields are particularly vulnerable. Fortunately, there aren't many of them.