Party continues in the transaction market

Investor interest in Trondheim remains very high. Liquidity in the transaction market is good, and we have so far registered 20 transactions with a combined volume of more than NOK 4 billion. At the same time, the signs are that the rental market will remain buoyant in the time to come.

Activity in the Trondheim region’s transaction market is maintaining the high tempo set last year. A wide range of assets have changed hands and, as in the rest of the country, office buildings account for a smaller proportion of the volume than before. We have only registered three transactions involving pure office buildings in the Trondheim region so far this year.

On the other hand, there have been many transactions in such segments as logistics and housing. Interest in the housing sector also made a big contribution to last year’s high volume, with Fredensborg, for example, involved in three different land purchases in the region and Denmark’s NREP buying a portfolio of rental homes for more than NOK 500 million.

* At NovemberSource: UNION. Property transactions over NOK 50 million.

In recent years, club-deal players have been the biggest net property buyers in the Trondheim region, and have thereby increased their exposure in the area considerably. This category has been less active in 2020, and club-deal players look like being net sellers in the region for the first time in nine years.

On the other hand, we see that big property companies such as Ragde Eiendom are increasing their exposure. Ragde’s transactions include acquiring a portfolio of eight retail properties leased to Byggmakker, and a logistics property at Tiller. NRP was the seller in both these transactions.

The biggest transaction so far this year is the acquisition of the five properties which now form the newly established Trondheim Areal company. This portfolio cost NOK 950 million, and the company – established through Clarksons Platou – is owned by Lerka Eiendom, Union Real Estate Fund II and a number of private investors. The owners have big plans for the properties, which are centrally located in Tunga. Development of a new urban district is planned in this area, including about 10 000 new homes.

Based on investor interest and indirect references, we have reduced our estimate for prime yield to 4.10 per cent. That represents a decline of 40 basis points since 1 January.

Source: UNIONLike the rest of the country, Trondheim experienced a dramatic rise in unemployment following the Covid-19 outbreak. In March, 10.3 per cent of the workforce in the municipality was registered as wholly unemployed. However, the labour market has recovered well. Unemployment in October was only 2.7 per cent, the lowest level among Norway’s four largest towns.¹

The rental market in Trondheim is rather less vulnerable than in the other large Norwegian towns because the public sector accounts for a higher proportion of employment. While public administration, health and education account for about 30 per cent of jobs in Oslo, this proportion is closer to 40 per cent in Trøndelag.²

Despite the substantial supply of space in recent years, office vacancy in Trondheim has declined. More than 140 000 m² of offices were completed in 2017-19, with about 62 000 m² becoming available in 2019 alone. Office vacancy today is about 7.3 per cent, after falling by 0.3 percentage points over the past six months.

Sources: Norion and UNION. Only confirmed newbuilds are included in the overview.New space totalling 30 000 m² is expected to become available this year and next, while that figure will probably rise to 50 000 m² in 2022.

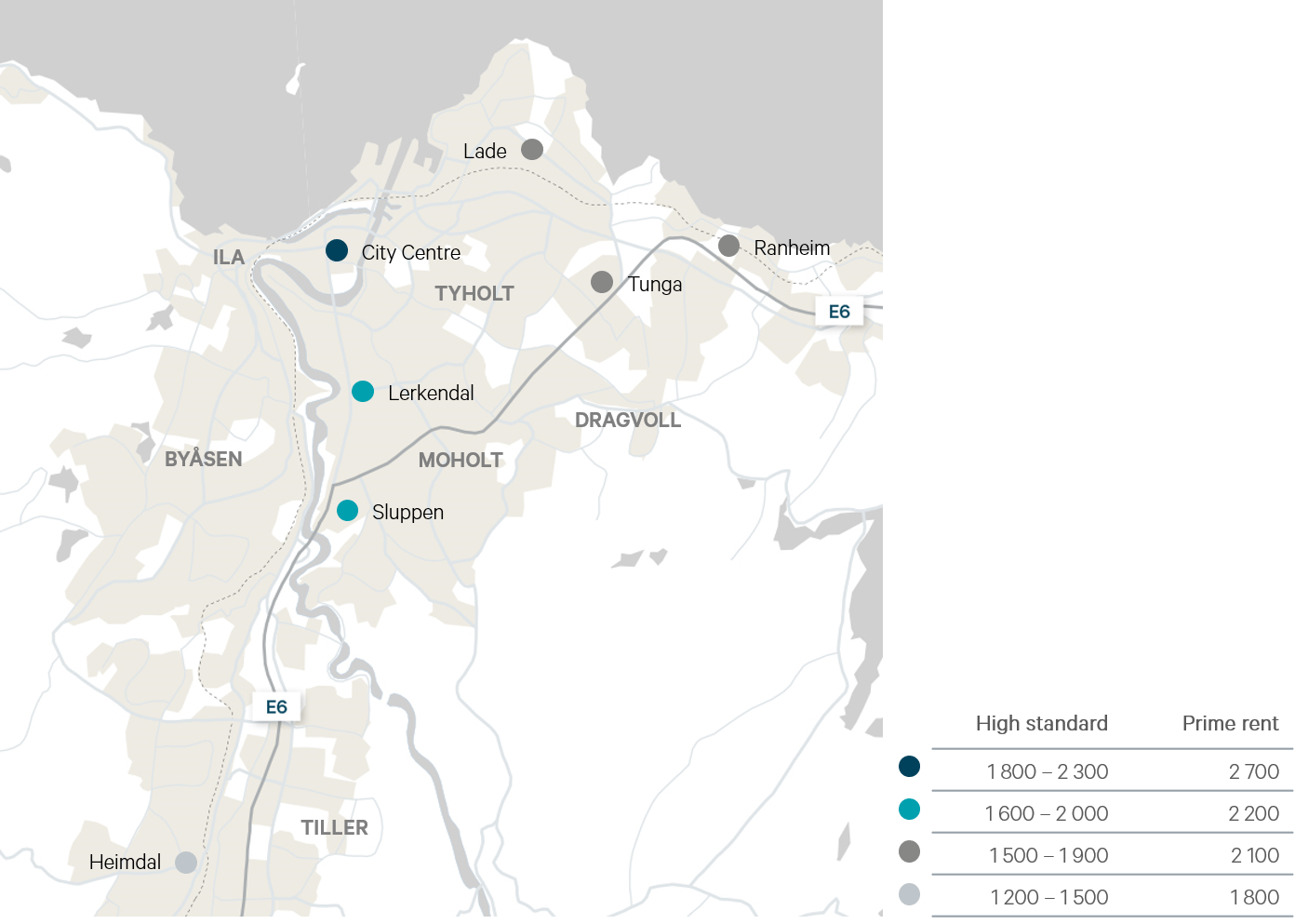

The combination of moderate office vacancy, a large public-sector presence and limited newbuilding paints a picture of a market which will remain in good balance over the time to come. This is reflected in rents, which have by and large remained at a stable level since last winter. We expect that trend also to continue in coming years.

¹ Source: NAV.

² Source: Statistics Norway.