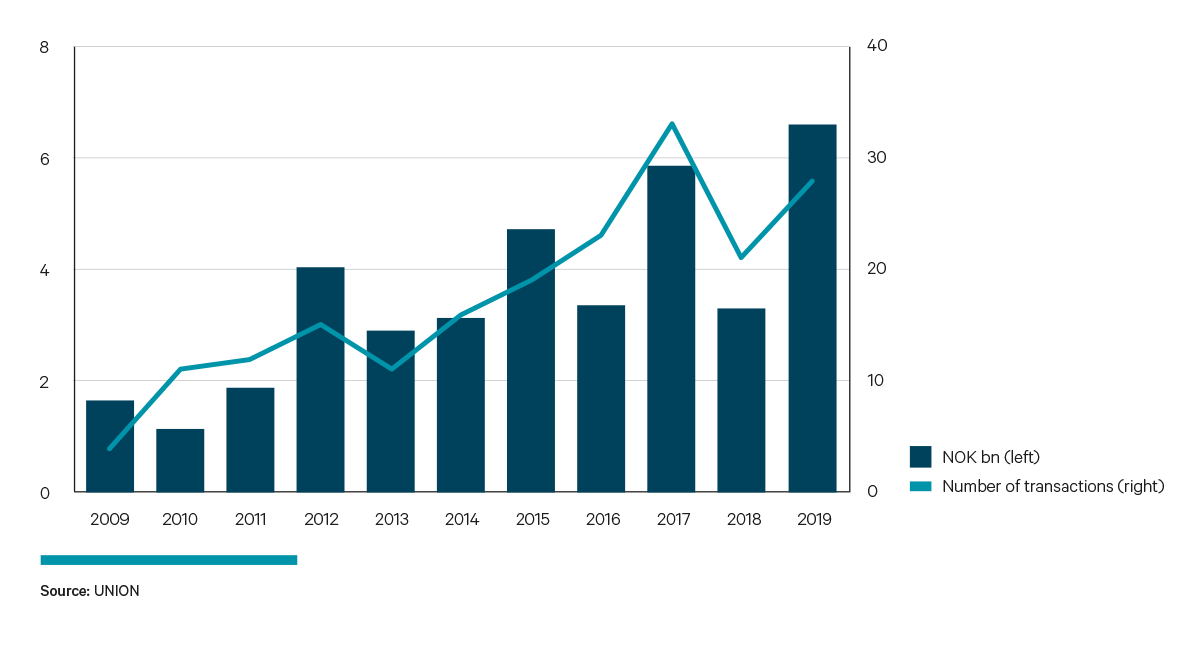

All-time high in the transaction market

We registered 28 transactions with a combined volume of NOK 6.6 billion in Trondheim for 2019, a rise of seven from the year before. Volume was record-high, up by NOK 3.3 billion from 2018 and NOK 3.2 billion above the annual average for 2010-18.

Transaction Market

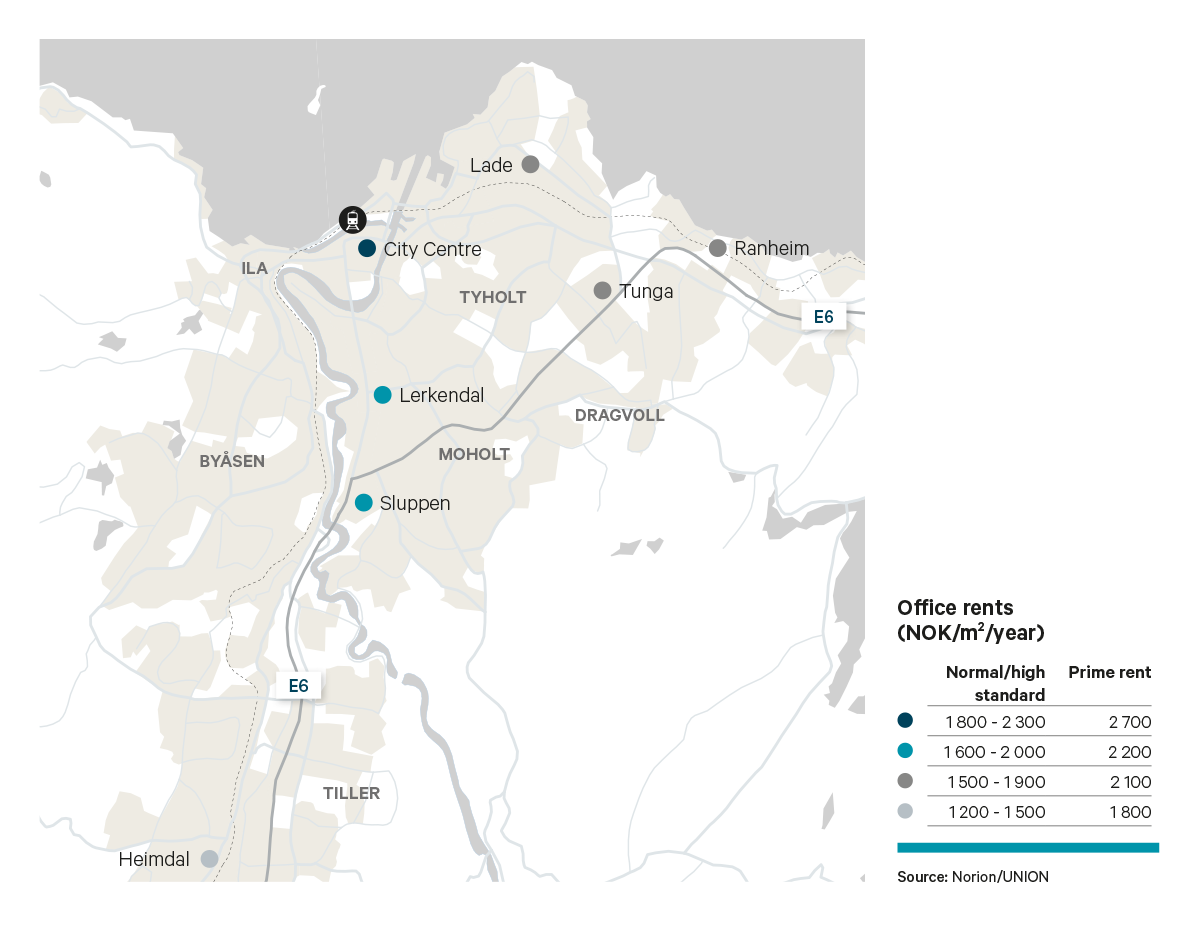

Club deal arrangers have been the biggest net buyers in the Trondheim region during recent years, but local investors and property companies accounted for the majority of transactions last year. At the same time, the region remains interesting for the arrangers when the right objects are for sale. A club deal arranged by Pareto, for example, acquired the new Lysgården building at Sluppen for NOK 440 million. Another arranged by NRP purchased a portfolio of seven builder’s merchants in Trøndelag county, which includes Trondheim.

Some city centre buildings were also to be found among the transactions. These include Barga Eiendom’s acquisition of Nordre gate 6 from Stendahl Eiendom, while E C Dahls Eiendom bought Olav Tryggvasons gate 27 from a private investor. We now estimate that the best office properties will achieve a yield of 4.50 per cent – down by 10 bps from our previous evaluation.

Rental market

After two good years in the Trondheim region, companies now expect growth in 2020 to be somewhat lower because willingness to invest is being constrained by macroeconomic uncertainty.¹ Employment growth picked up in the course of 2019, and the 12-month increase for the region was 1.8 per cent.² Companies remain optimistic about the future and envisage increased jobs growth even in a tight labour market. Progress has been particularly good in fishing and aquaculture as well as tourism. The weak krone exchange rate has made a good contribution to these industries.

Office vacancy in Trondheim is now 7.8 per cent.³ This figure is boosted by a number of outdated buildings on the city’s fringe. New, efficient and centrally-located properties are in short supply. Demand for such buildings is high, with the willingness to pay for them therefore growing.

Some 200 000 m² of new office space was completed in 2017-19, including no less than 70 000 m² in 2019 alone. Supply-side growth was particularly high in downtown Trondheim and at Sluppen. Entra, for example, completed the Powerhouse in the city centre in March 2019, with Sopra Steria, Skanska and Enova as tenants in this 18 200 m² office building. And KLP Eiendom finished the 9 925 m² Lyngården at Moholt last April.

Expansion on the supply side is likely to be smaller in coming years. We expect 41 500 m² of office space to be completed in 2020-21. Entra, which has developed several Trondheim newbuilds in recent years, has launched the first stage of Midtbyen at Lerkendal. This 11 700 m² building is due to be ready in the spring of 2020, with the Norwegian Tax Administration and the Norwegian Hospital Construction Agency leasing 5 000 and 2 220 m² respectively. Entra has also initiated the second construction stage for Trondheimsporten to provide 16 000 m², with completion in 2021. The City of Trondheim has signed a lease for about 5 000 m² in this building.

¹ Source: SpareBank1’s business trends survey.

² Source: SSB (number of wage-earners).

³ Source: Norion.