Softer landing this time

The Stavanger region has experienced declining office vacancy over the past half-year. Following a quiet first half in the transaction market, the year is likely to end with a very hectic spurt.

Office vacancy in Stavanger1 is now 10.7 per cent, down only marginally from the spring. However, developments have moved in the opposite direction in the city centre, owing to considerable newbuilding and internal relocation. Vacancy there is now 20.4 per cent, and has increased by 2.2 percentage points in the past half-year. At Forus, vacancy has remained stable over the same period and is now 13.6 per cent.2 Uncertainty prevails over the future development of office vacancy in the region. It is still higher in Stavanger than in other large Norwegian towns.

Employment in Rogaland after Covid-19 and the oil price slump has developed more or less in line with Norway’s other counties.3 However, companies exposed to the oil sector – which have so far been able to keep going with order backlogs – now face a substantial drop in turnover. Three out of four of them expect a drop in their workforce.4 A substantial decline in oil investment is also expected next year, with Statistics Norway expecting a fall of around 10 per cent. This drop primarily reflects an expectation that development projects will move into a final phase.

Source: UNION. Only confirmed newbuilds are included in the overview.However, there is no reason to believe that vacancy will rise sharply in the region, since companies have already reduced their use of space substantially through downsizing rounds in 2014-15.

Newbuilding activity has also come to a complete halt for the moment. New office space completed in 2020 will total 12 500 m², about half the average for recent years. While no buildings are due for completion in 2021, Base Property envisages finishing a new office building totalling 15 000 m² at Knud Holms gate 8 in central Stavanger the year after. Only 26 000 m² in new office space has been confirmed as entering the market in 2020-22. The newbuild volume will be considerably lower this time than in the previous downturn.

After a standstill in the rental market before the summer, tenants have begun to stir a little in the autumn. One example is Norske Shell. With about 500 employees and a head office in Risavika, it is looking for new office premises for roughly 300 personnel with takeover before 31 December 2022.

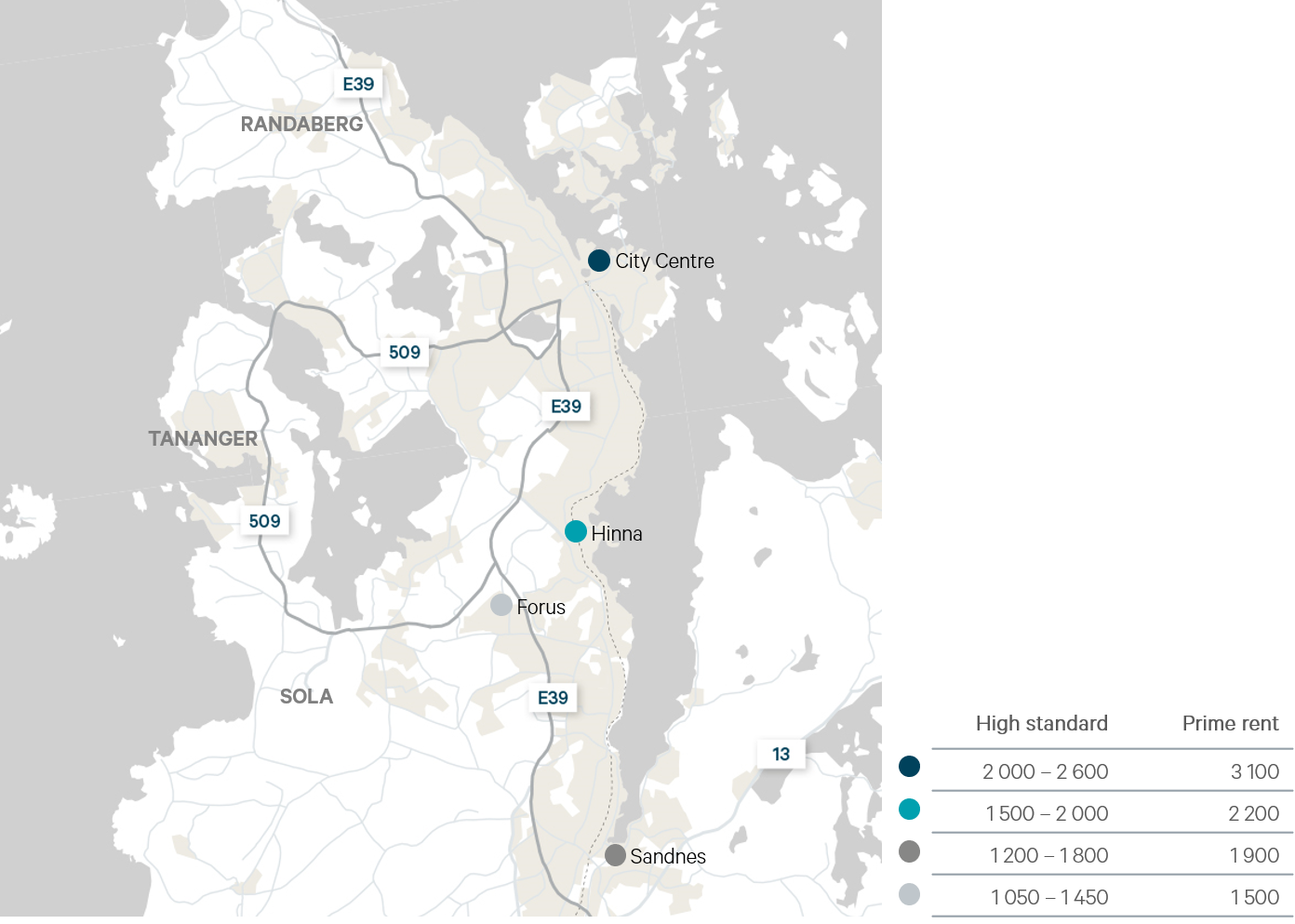

Rents in the Stavanger region remain roughly stable. While a weak downward pressure on rents is to be expected in the time to come, however, it will be nothing like as strong as we saw after the previous oil crisis.

Transaction market

So far this year, we have registered a volume of NOK 2.9 billion spread over 12 transactions. After a quiet first half, activity in transaction market has risen substantially. Based on what we know about in the market, we believe the volume will end above last year’s NOK 5 billion but below the level of NOK 10 billion seen in 2018.

* at NovemberSource: UNION. Property transactions over NOK 50 million.

The Øgreid family’s sale of Herbarium in central Stavanger to Oslo Pensjonsforsikring has been by far the biggest transaction this year, and accounts for a large proportion of the registered volume. It gives support to sharp pricing for quality properties in the downtown area. Otherwise, big-box retail properties have been particularly popular with buyers so far this year, accounting for half the number of transactions during and after the Covid-19 outbreak. We estimate prime yield in Stavanger at 4.25 per cent.

Source: UNION1 Stavanger region (Stavanger, Sola and Sandnes).

2 Source: Eiendomsmegler1.

3 Source: Statistics Norway.

4 Source: SpareBank 1.