Saved by supply

No Norwegian county containing a major town has suffered a larger drop in employment than Vestland, but Bergen’s office rental market will probably be rescued by a favourable supply position.

Like the rest of Norway, companies in Bergen have been hit by the economic downturn following the pandemic. Taking Vestland as a whole, more than 11 000 jobs have disappeared over the past year – a fall of 3.6 per cent. That is roughly one percentage point higher than Oslo and Rogaland.¹

About as many jobs vanished in the county during 2015 and 2016 as over the past year. At that time, however, the downturn coincided with a high level of completions for new office space. Bergen’s newbuild volume in 2015 alone was 115 000 m², almost three times higher than in a normal year. A great deal of new space was also completed in 2013 and 2014, and vacancy consequently increased from around seven per cent in 2013 to more than 10 per cent in 2016.²

Today’s position is very different. Only 35 000 m² is due to be completed in 2020-21. We have only registered two certain newbuilds in 2022. Bara Eiendom has launched the fifth construction phase at Kronstadparken in Bergen without having awarded any leases. This 14 000 m² building is expected to be ready in January 2022. In addition, Bir Eiendom is constructing a small office building at Lungegårdskaien 42.

* At NovemberSource: UNION.Only confirmed newbuilds are included in the overview.

It also became clear recently that Entra has awarded a lease of 5 600 m² to the Labour and Welfare Administration (NAV) at Møllendalsveien 6-8. NAV will move into this 14 500 m² office building when its refurbishment is completed in the fourth quarter of 2021. The lease runs for 10 years, and 44 per cent of the building is leased.

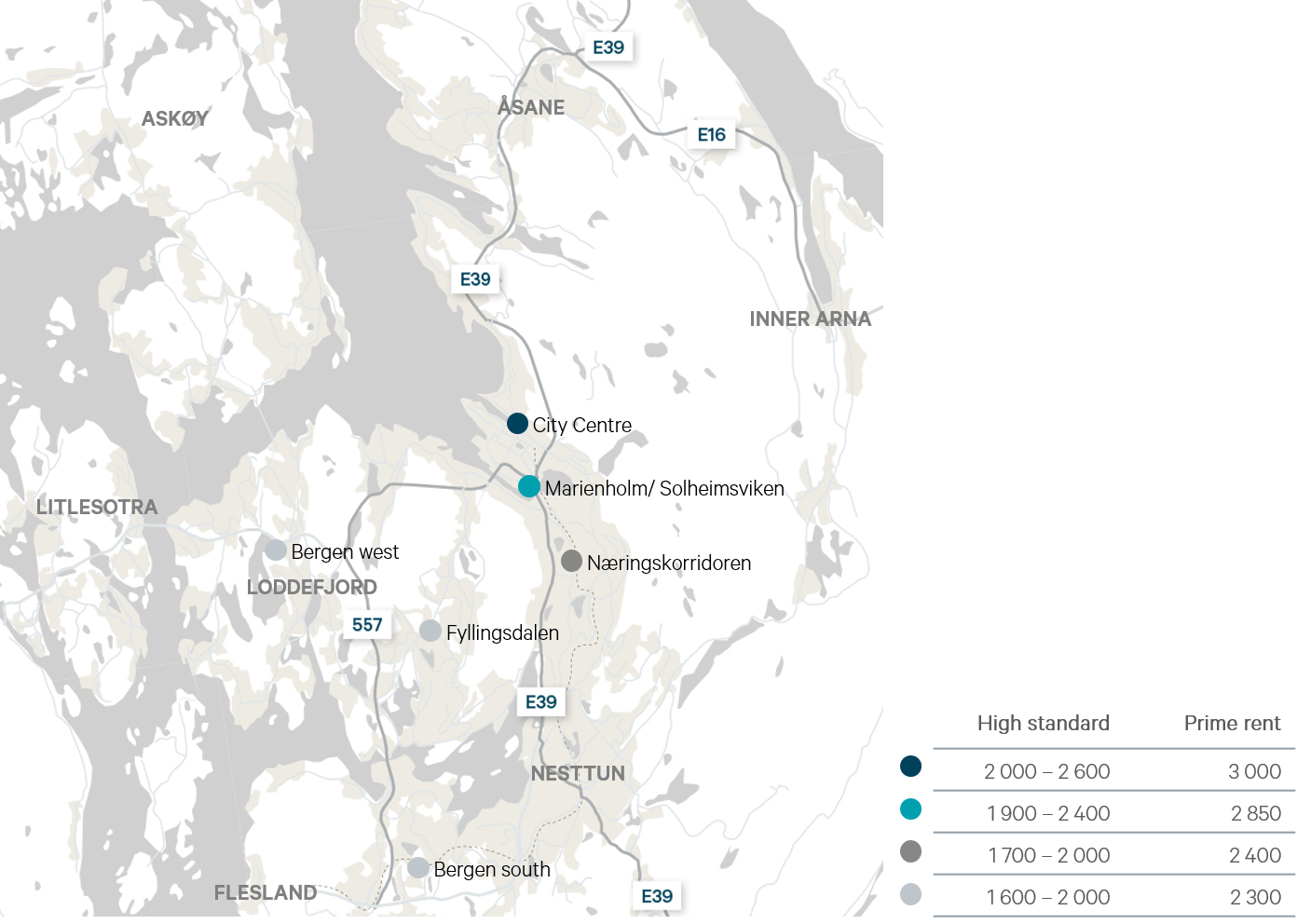

Few good references are available after the summer for the level of rents in the best premises, but the indications so far are that it has largely stayed unchanged in central districts. Prime rent for offices is still estimated to be around NOK 3 000 m²/year. In Bergen South, where vacancy has been high since the previous oil crisis, the level of activity is low and pricing more uncertain.

Macro developments will probably contribute in any event to increased office vacancy and a weak downward pressure on rents. However, we believe that the downside will be restricted by the low rate of newbuilding.

Transaction market

We have registered 14 transactions totalling NOK 3.6 billion in the Bergen area. That does not include Bergen’s share of the portfolio transactions by Telenor and Veidekke Eiendom. A hectic final spurt is likely in the transaction market, but our view is nevertheless that it will not quite reach last year’s volume of NOK 10 billion divided between 39 transactions.

Source: UNION. Property transactions over NOK 50 million.The biggest transaction this year is Sparebanken Vest’s sale of Jonsvollskvartalet, its own head office in central Bergen. The property was sold for NOK 1.62 billion to KLP Eiendom. Totalling 19 300 m², this office building houses Norne Securities, Frende Forsikring and Brage Finans in addition to Sparebanken.

The sale of Jonsvollskvartalet confirms that heavy pressure on yields also prevails in Bergen. We have reduced our estimate for prime yield in Bergen by a total of 50 basis points since last autumn, and now calculate that the most attractive office buildings typically achieve a yield of 3.75 per cent.

Source: UNIONAnother large transaction is the Telenor building at Ytrebygdsvegen 215 in Kokstad. Zuhaar & Rubb has acquired this 31 800 m² office building from Midgard Gruppen for about NOK 750 million.

In addition come a number of smaller transactions in the city centre. West Coast Invest has acquired Torgallmenningen 3A from Hui Gruppen, while JOF Eiendom has purchased Strandgaten 68 and 71 for NOK 67.5 million from Hans Petter Moe.

¹ Source: Statistics Norway.

² Source: WPS.